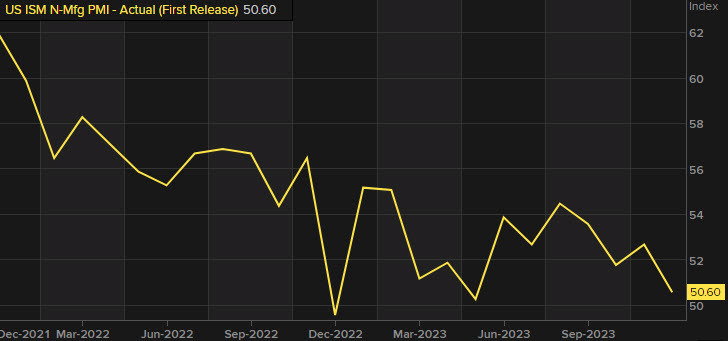

ISM services Dec

- Prior was 52.6

Details:

- Employment index 43.3 versus 50.7 prior

- New orders 52.8 versus 55.5 prior

- Prices paid index 57.4 versus 58.3 prior

- New export orders 50.4 versus 53.6 prior

- Imports 49.3 versus 53.7 prior

- Backlog of orders 49.4 versus 49.1 prior

- Inventories 49.6 versus 55.4 prior

- Supplier deliveries 49.5 versus 49.6 prior

- Inventory sentiment 49.6 versus 62.2 prior

This is some dovish stuff. Remember, the ISM services report is a great forward-looking data point while non-farm payrolls is a laggard.

The prices paid and employment numbers are particularly dovish.

Comments in the report

- “Pricing has become more favorable, in increments. However, beef prices are still high. Petroleum continues to fluctuate. Services has come down slightly, but hourly rates are still higher than pre-pandemic (levels).” [Accommodation & Food Services]

- “Congestion at the Panama Canal is expected to continue for the next several months. The effect of this is rerouting marine cargoes at the expense of cost and schedule.” [Construction]

- “Business conditions are generally good, except for a short supply of major electrical components.” [Educational Services]

- “Revenues remain strong but labor is still constrained, and suppliers are floating price increases beginning January 1, which will likely further reduce already low operating margins. Supply chains appear to be operating closer to pre-pandemic norms and remain mostly stable. Our primary goal for calendar year 2024 is expense reduction across the board, including for supplies and services as well as through eliminating non-value-added pursuits.” [Health Care & Social Assistance]

- “If interest rates go down, investment borrowing will increase, as will orders for services.” [Information]

- “Production and sales are up, and prices are down.” [Mining]

- “Hiring of direct employees, consultants and contract workers remains flat across most industries as the holiday season is in full swing and economic concerns persist. Companies are taking a wait-and-see approach to increasing labor costs as they continue to try to do more work with less people.” [Professional, Scientific & Technical Services]

- “Final push for the holidays. The supply chain and sales are strong — pricing stable.” [Retail Trade]

- “We have seen a typical slow seasonal change in business. This is not unexpected and remains at a higher level than in the previous two years.” [Transportation & Warehousing]

- “There is more stability in the supply chain for the first time since early 2020. Overall level of business activity is still relatively high.” [Utilities]

- “Business is still robust in our area, despite the normal holiday lull. We should see business resume after the first of the year if good weather prevails. Mortgage rates are continuing to fall, which is aiding in affordability. I think the first quarter will yield good demand.” [Wholesale Trade]