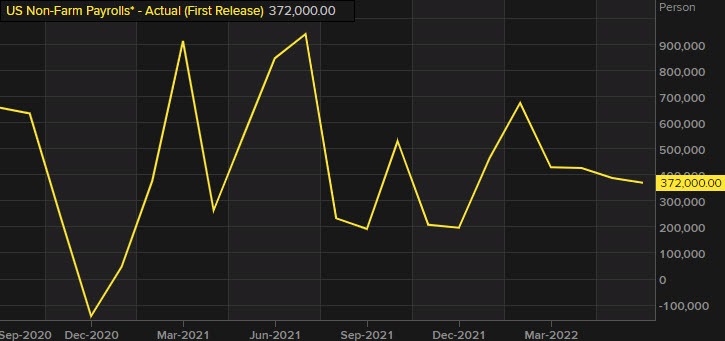

- Prior was +390K (revised to +384K)

- Estimates ranged from +75K to +325K

- Two month net revision K

- Unemployment rate 3.5% vs 3.6% expected

- Prior unemployment rate 3.6%

- Participation rate 62.1% vs 62.2% prior (was 63.4% pre-pandemic)

- U6 underemployment rate 6.7% vs 6.7% prior

- Average hourly earnings +0.5% m/m vs +0.3% expected

- Average hourly earnings +5.2% y/y vs +4.9% expected (prior 5.1%)

- Average weekly hours 34.6 vs 34.5 expected

- Change in private payrolls +471K vs +230K expected

- Change in manufacturing payrolls +30K vs +17K expected

The odds of a 75 bps bike have jumped to 61% from 40% on the release.

Good news is certainly bad news here and bonds have slumped along with stock futures . However for the US dollar , good news is good news and USD/JPY has spiked to 134.31 from 133.22.

This will be an enormous challenge for the recent rebound in the risk trade.

One caveat in all this is the household survey, which showed just 179K jobs and 239K people leaving the labor force. It has been much weaker than the establishment survey lately. In the past four months, the establishment survey has shown 1.8m more jobs than the household survey.