The unloved Euro dips again

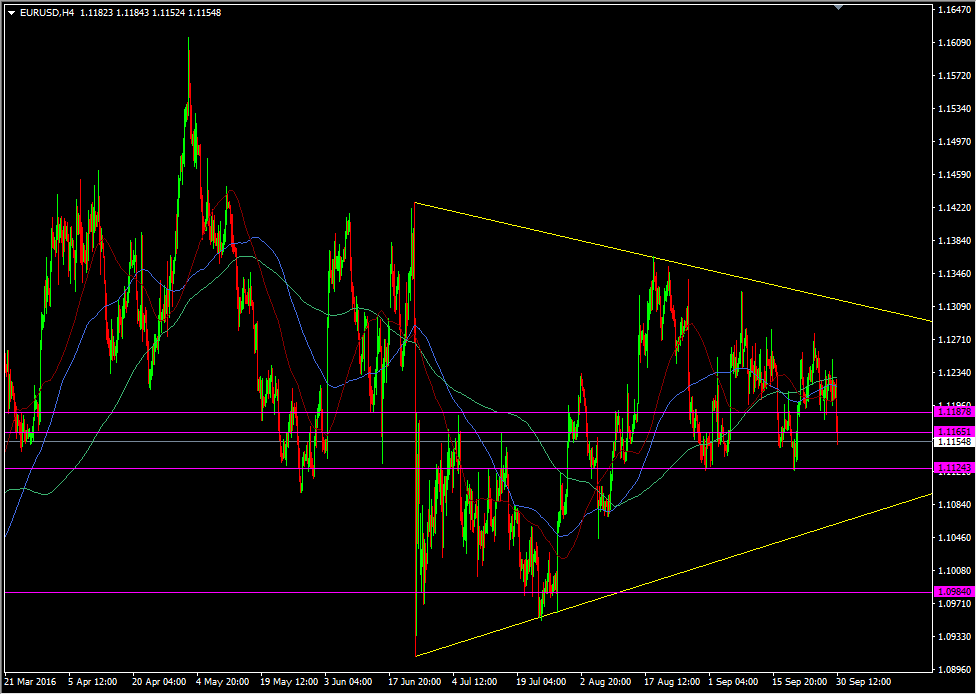

EURUSD has slipped through support around 1.1160 by a few pips as the sellers still keep the pressure on. The 200 dma is in play here at 1.1159, as is the 55 and 100 at 1.1177 and 1.1185. A close below all three could be trouble. There's not much love for the euro right now but even so, we're still within the recent ranges.

EURUSD H4 chart

1.1120/25 was support through Aug/Sep and we're edging closer to it again, and have the 55 wma just under at 1.1115. This move looks to be on the back of general USD strength seeping in. USDCHF is on the rise again and USDJPY has been creeping up too.

A look at the lower end of the range down towards the trend line is where I'd be interested in a long. The DB worries are one thing weighing on markets right now but I'm going to have a bit of faith in the EU and ECB that all the backstops they've been promising and working on shouldn't make a worst case scenario, for DB, that bad. And that's if we see a worst case scenario, which I don't think we will.

For now, 1.1160/65 needs to be re-taken to remove this pressure and 1.1190/1.1200 will be next resistance. Should we test and break 1.1120, then the big figure will likely be tested too.