The Aussie's recovery against USD may be more cross driven but it's a pretty strong move in its own right

The bounce backs from risk aversion are becoming snappier and that suggests that the China excuse is wearing thin. We've still got plenty of volatility from stocks and elsewhere but the willingness to reverse these risk off moments quickly is a telling sign

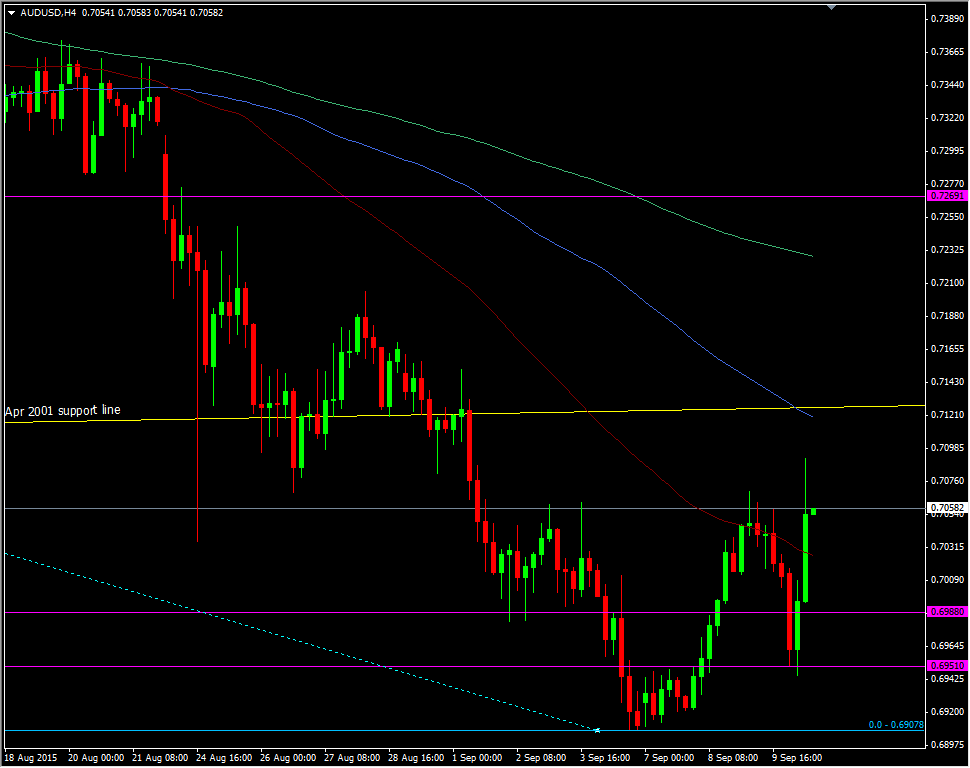

AUDUSD has bounced strongly from the overnight lows at 0.6946 to test 0.7100. That move alone would have got some short term shorts quite worried. There been a lot of profit taking in the mix following the RBNZ action and it's been the Aussie crosses that have helped drive it up. AUDNZD is up nearly 300 pips and EURAUD is down nearly 400

For the moment this second dip to 0.6950 marks strong protection of the 0.69 lows and that's a strong enough signal to show the change of the current sentiment, even if it's a short term change

AUDUSD H4 chart

The interesting level to watch next will be the broken 2001 support line up at around 0.7125/30. We traded it indecisively on the way down and it could well feature again on the way up

Sometimes a market or trend just plain runs out of steam and gets to the point where it can do no more for the time being. Maybe the reasons have changed or they lose strength but once you get that change in mindset that usually means the short term picture has changed

EURGBP is similar. We finally got the break through the March lows at 0.7000 level but then couldn't do anymore. We flip flopped around 0.7000 for a bit, then broke higher. Now it hasn't looked even remotely interested in going back down to the lows

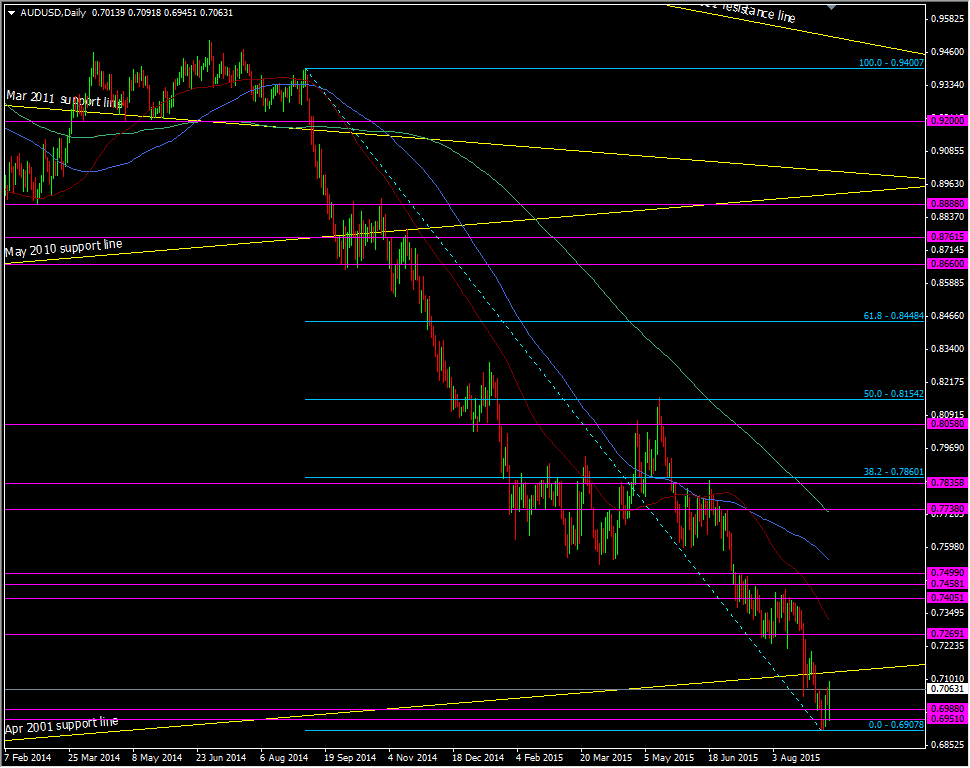

These moves do not put an official stamp on AUDUSD that the trend is over. What it does do is say is that we may consolidate or that the short term path is back up

The longer term trend remains intact while the bigger topside levels remain far away. The 38.2 fib of the 2014 swing isn't until 0.7860. There's still plenty of strong levels on the way up there too

AUDUSD daily chart

For now reloading shorts for anything longer than an intraday trade could be the riskier trade and longs from the low 0.70's may be the better play. For longer term traders patience is more likely to be required. Sit back and let the market show you what it wants to do. Watch the higher key levels and use the action against them to decide whether the time is right to add or initiate shorts

Of course, tomorrow, in 5 minutes, in 2 days, we could be trading at 0.68 on some event or another and this post becomes toilet paper. That's not the point. The point is that for now I see something different in the price action and that something is enough to pay close attention to as it could mean the difference between making or losing money