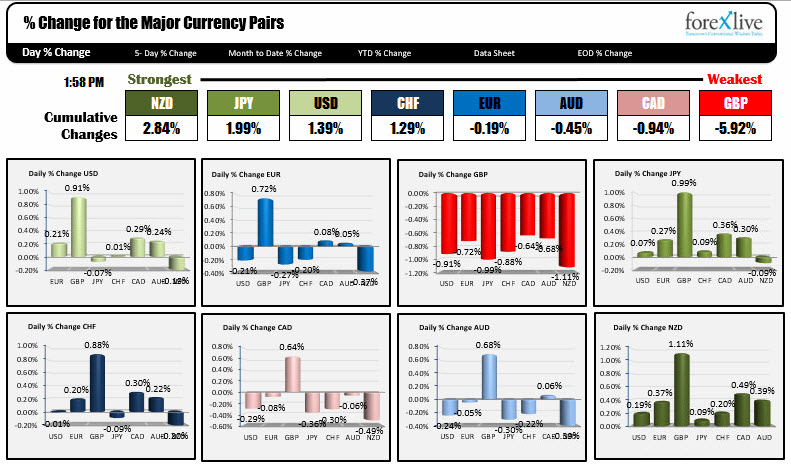

GBPUSD remains the weakest (and got weaker).

The currency markets have gotten quiet as the NY afternoon continues.

The greenback has extended gains against the GBP, EUR, AUD, and CHF, but has lost ground against the JPY and NZD. The pair is still higher against the CAD, but the USD has gotten weaker over the last hour or so.

Below is a quick technical review of the some of the major currency pairs:

EURUSD

The EURUSD extended a 24 pip trading range at 8:00 AM to a 46 pip trading range. It is still short of the 68 pip average seen over the last 22 trading days (about a month of trading) but it is respectable at least.

The price fell below the low from last week at 1.1131 and in the process also fell below the 200 bar MA on the 4-hour chart at the same area. The next target is the end of May low at 1.1108. A broken trend line on the daily chart cuts across at 1.1105. The low reached 1.1181. Stay below the low from last week and 200 bar MA at 1.1131 keeps the sellers firmly in control.

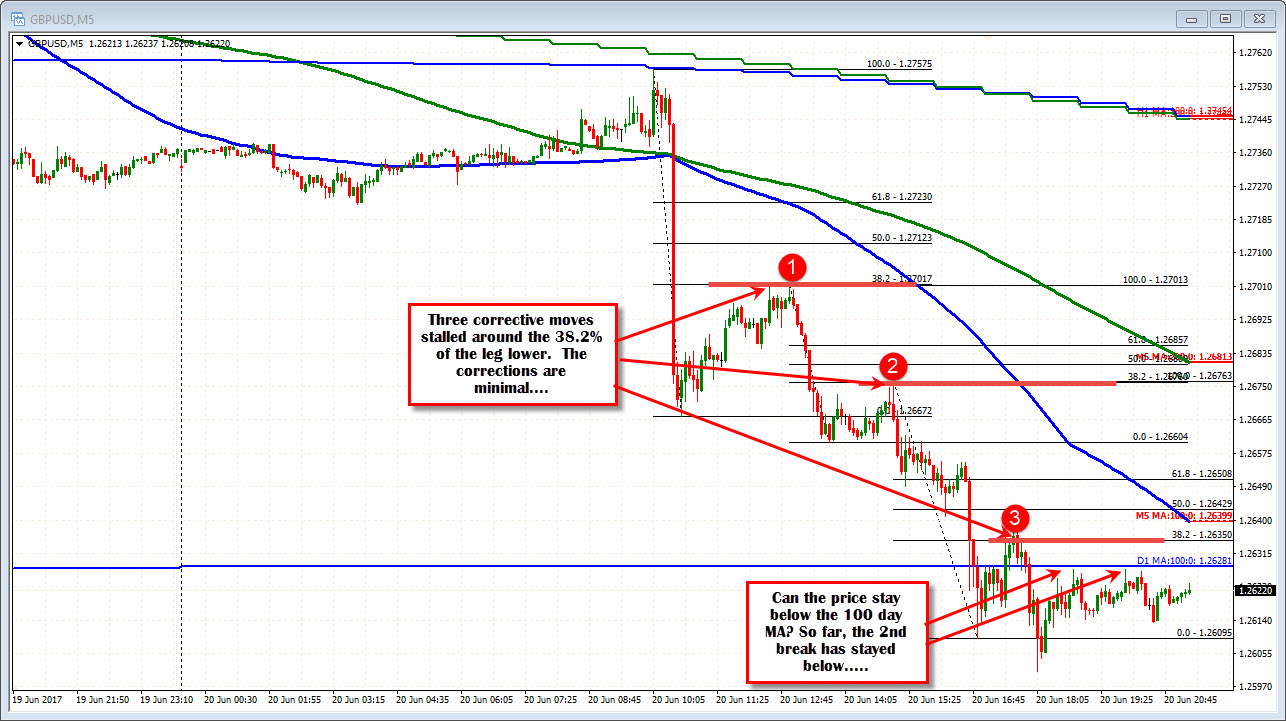

GBPUSD.

The GBPUSD fell below it's 100 day MA twice now. The first move stalled and moved modestly higher. The corrective move stalled around the 38.2% of the last trend leg down today (that is not the 38.2% of the move down, just the last leg lower -see chart below). Looking at the 5-minute chart below, the price has stayed below the 100 day MA since the 2nd break. That is the bearish news. The not so bearish news - in the short term at least - is that the new low did was not sustained (we trade above 1.26095).

AUDUSD

The AUDUSD fell to session lows in the NY session but found support buyers near key support defined by the 200 hour MA (green line in the chart above) and the 0.7566 level. That level was a ceiling pre-June 14, and a floor post- June 14 (see thick red line). Stay above the 0.7566 is good for the dip buyers. Move below is not good for the dip buyers. ON the topside the 0.7584 lows from yesterday and earlier today is a level that if broken above, would give the dip buyers more happiness.

USDCAD

The gains in the USDCAD on the back of lower oil prices are being eroded. The pair is back below the most recent swing highs on the hourly at 1.3262 and 1.32568 and looks toward the 100 hour MA at 1.32405. That is a key risk level for longs. The price has to stay above that MA to give the dip buyers hope. A move below and the 1.3208-11 becomes a support target. On the topside, the 200 hour MA and 38.2% retracement at 1.3306 is close to the high form Friday at 1.33075. Key level if this pair is going higher.