USDJPY blasts through 122.00 offers to the highest since July 2007

When she blows, she blows good does USDJPY

There were reportedly $1bn in offers taken out at 122.00 on EBS, report London traders. The stops were then blown at 122.20 and barrier busted at 122.50. Leveraged accounts were one of the big buyers noted and traders say there have been a lot of new long positions added in this run

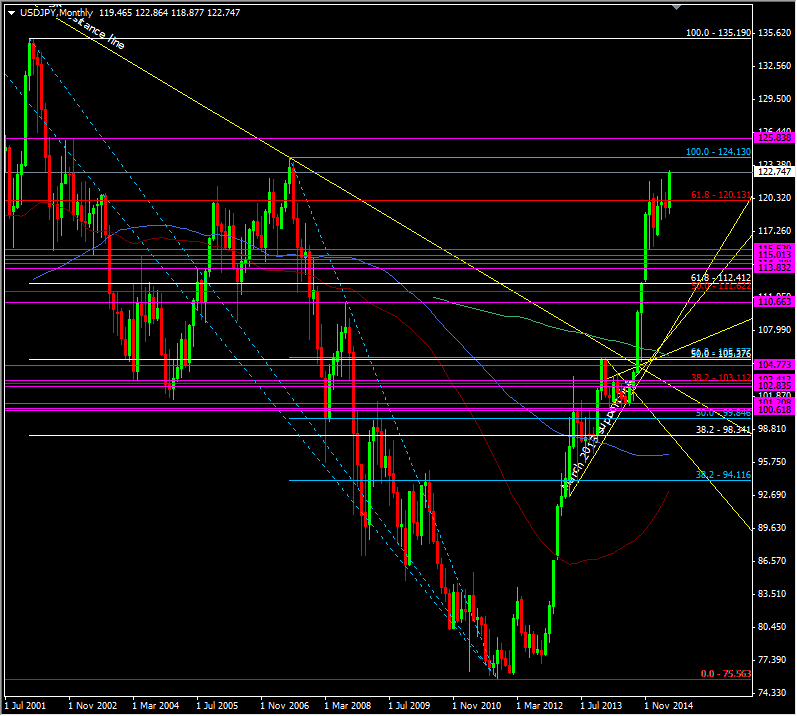

Now we've finally broken out from the recent range we'll either keep trucking on for another couple of hundred pips or find a top and start consolidating again. I'm inclined to think that we see more upside from here at least until the July 2007 high at 123.66 and the June 2007 high at 124.13

USDJPY monthly chart

It looks like 122.45/50 is our first line of confirmed support then there may be mild support around 122.35 and where the stops were bashed at 122.20/25. The stronger level is down at 121.70/75 and 121.45/50

As we've seen with rallies in this pair it very rarely gives you a chance to play catch up with a decent dip. We've got some volatile data up later with durable goods and then followed by more housing data via new home sales

For what it's worth my shorts we're kicked out on the break of 122.00. I think I'll just get back to doing what worked previously and that was jumping on the dips. This move is far to strong to mess with