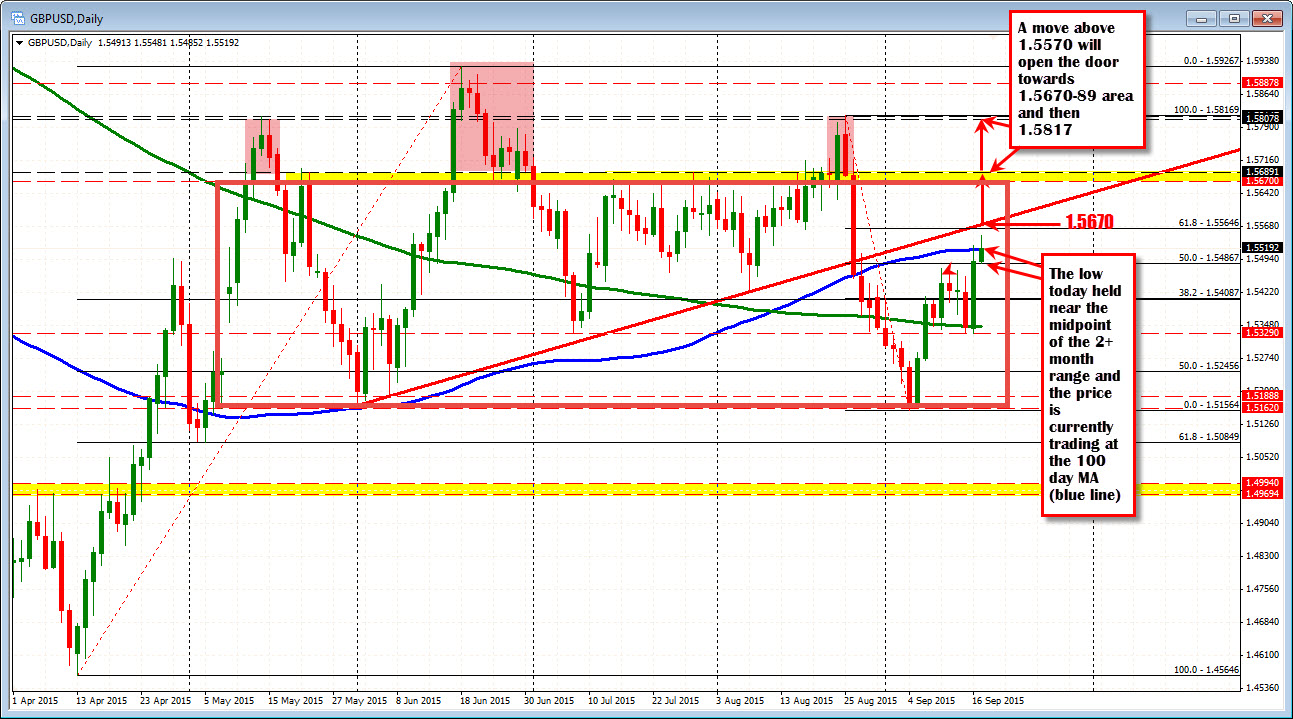

100 day MA today but not sustained

The 100 day MA at the 1.55185 level was broken yesterday with the high price reaching 1.5527 before moving back lower. Higher wages was the catalyst for a sharp moved higher in the GBPUSD yesterday. The move higher continued today with the pair extending to the highest level since August 26th. That pushed the price to 1.5548.

Although higher, the path traveled has been a rocky one with swings up and down along the way (see the 5 minute chart below). The price managed to extend back up to the London morning session high, but was not able to break that level. That failure as led to a 50 or so pip move lower and in the process took the price back below the 100 day MA (we are currently trading above and below the MA as I type.

FOMC decision day jitters? Sure? The fed is sitting on the fence and so is the market. So going back closer to a comfortable place - like the 100 day MA makes sense. Let the Fed decide the next move.

If the Fed hikes, the gains over the last few days should see some erosion. The downside targets become:

- 1.5474 (high from Sept 10)

- 1.54386 - 50% of the surge higher over the last two days.

There is a case that the BOE might take a "if the Fed can do it, so can we" attitude. So keep an eye out for support levels to hold and the 50% of the move higher is a nice place to stall/stop. If it goes below that level some further back filling can be expected with the 1.5396-1.5412 another important line in the sand for the pair. The price going back to the end of August to September 10 price traded below that level. Since September 10 most of the activity has been above. Yes it was just below that area on Tuesday and Wednesday before the employment stats, but if that report changes the markets mind, the dip should stay in the RED box.