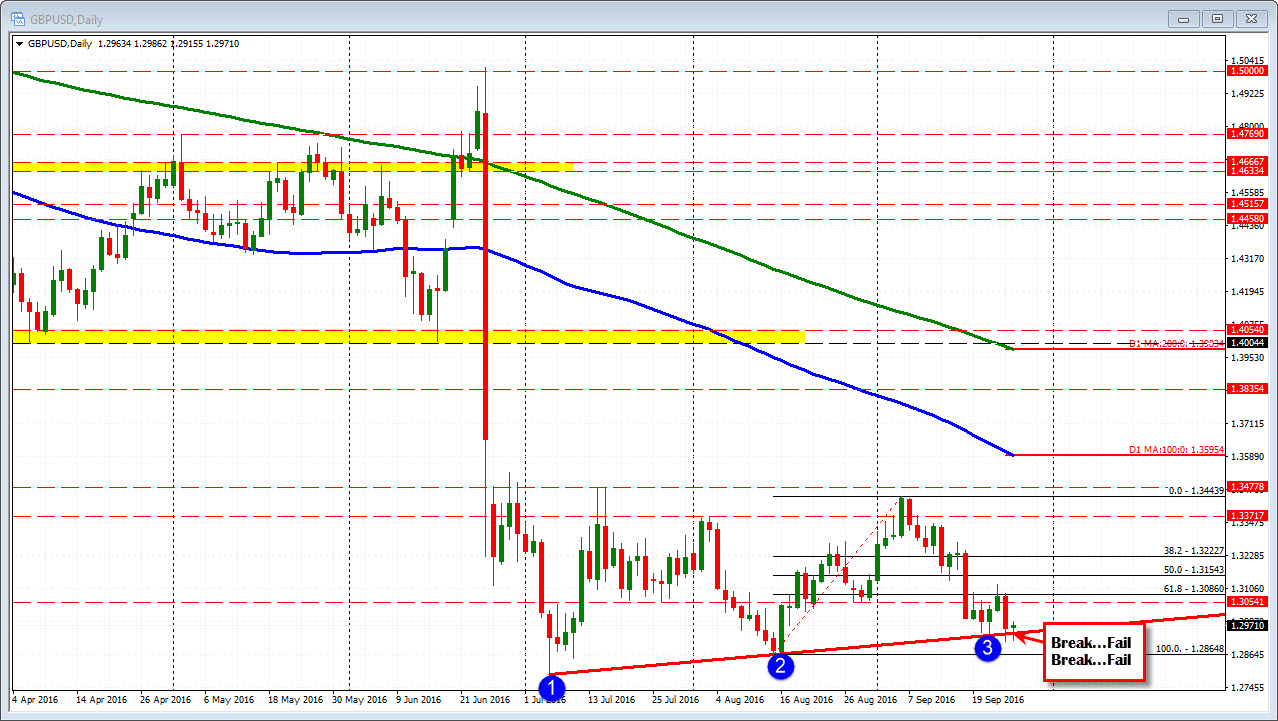

Shorts took two shots and missed

The shorts in the GBPUSD have taken two shots to the downside and each one missed it's targets.

The first shot was taken on Friday when the pair moved below the Tuesday/Wednesday lows at 1.2944. The price extended to 1.2914 but bounced back quickly. The price moved above the 1.2944 level, and then held support against the same level. on a test (blue circle 3).

The second shot was on a move back to the lows today (and below the 1.2944 level). Once again, the break failed and the price has moved back higher. The low today was within 1 pip of the low from Friday. We are back above the 1.2944 level.

The failures and move back higher should be more supportive for a correction (reminds me of the move of the double bottom on Sept 21). We are higher on the day (closed at 1.2960 on Friday - a close risk level would be that level for traders). We are above the downward sloping itrend line. We failed to extend to new lows at the day's lows.

There are hurdles ahead including the 38.2% of the move lower at 1.2993, and then the 100 hour MA at the 1.30028 level A move above each is a more bullish step in the right direction, but understand there are other hurdles ahead that can turn the beat around (the buying in the is pair has had limits).

Nevertheless, for now, traders are more supportive.

PS Looking at the daily chart, the moves to new lows also broke a trend line on each break, and each one failed.....