The floor proved to be solid

The EURUSD is trading at a session high and looks toward a test of 1.1800. The move to the upside has been choppy steps. The week has been mostly lower. So a corrective move tends to be more difficult.

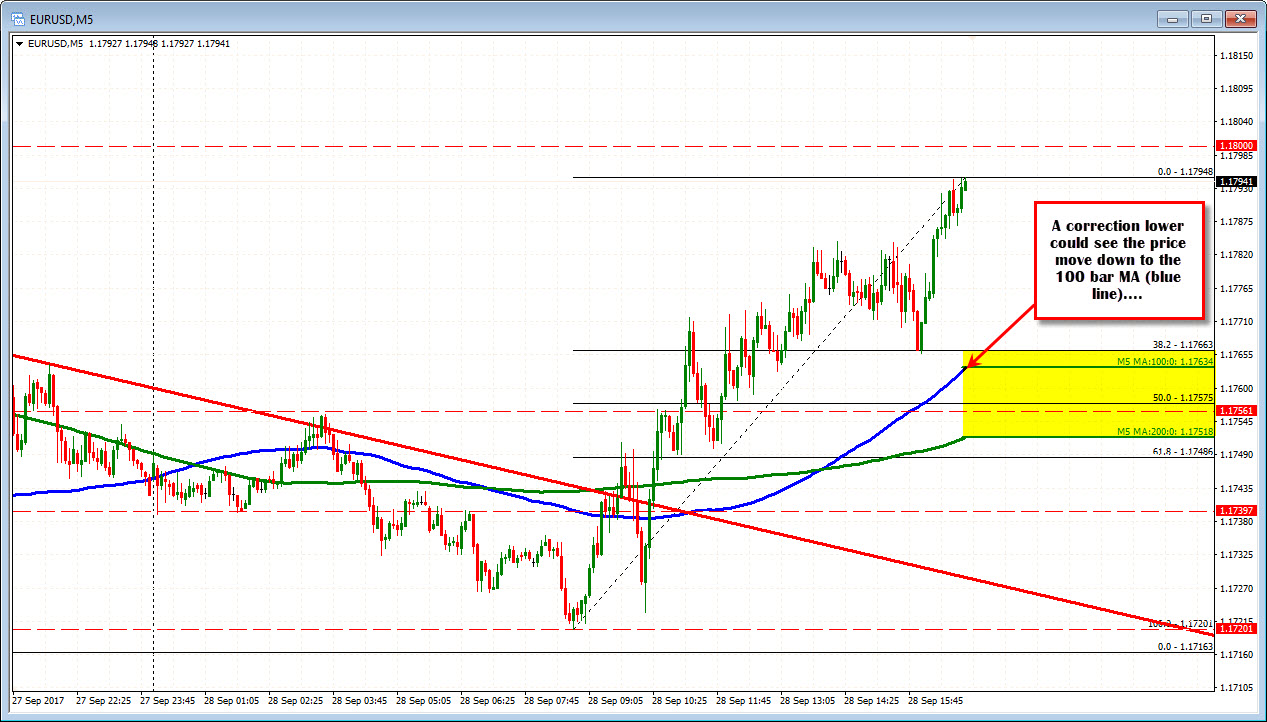

Having said that, the lows today showed that a good support floor is in place. The 1.1711-20 area is home to a lot of key levels:

- The 38.2% of the move up from the June 20 low (last swing move higher) comes in at 1.17201

- The 200 week MA comes in at 1.1718

- The August 2015 swing high comes in at 1.17111

Yesterday, the low stalled at 1.1716 between the levels.

Today the low traded to 1.17201.

That's solid.

What now?

The 1.1800 level is a natural resistance area and above that is a more important level at 1.1822-275. This area defined the swing low of the up and down trading range from August 25th until the break below on September 26th (see red box on the chart above). The 100 hour MA is also in this area, as is the 38.2% of the move down form the high last Friday.

As important a technical level at the 1.1711-20 is, the 1.1822-275 is as an important resistance level. The pair should not reenter that 22 plus days that formed that up and down trading area (red bos in the chart above), nor breach the 100 hour MA or 38.2% resistance if the sellers are to remain in control.

Look for sellers against the area with stops above.

On the downside, what the 100 bar MA on the 5-minute chart to give a clue on moves lower.

SUMMARY;

- Great support held

- There is great resistance above at the 1.1822-275 area.

The 1.18000 is a natural resistance area ahead of the key resistance target above. On the downside eye the 100 bar MA for a support level...