It's Friday.

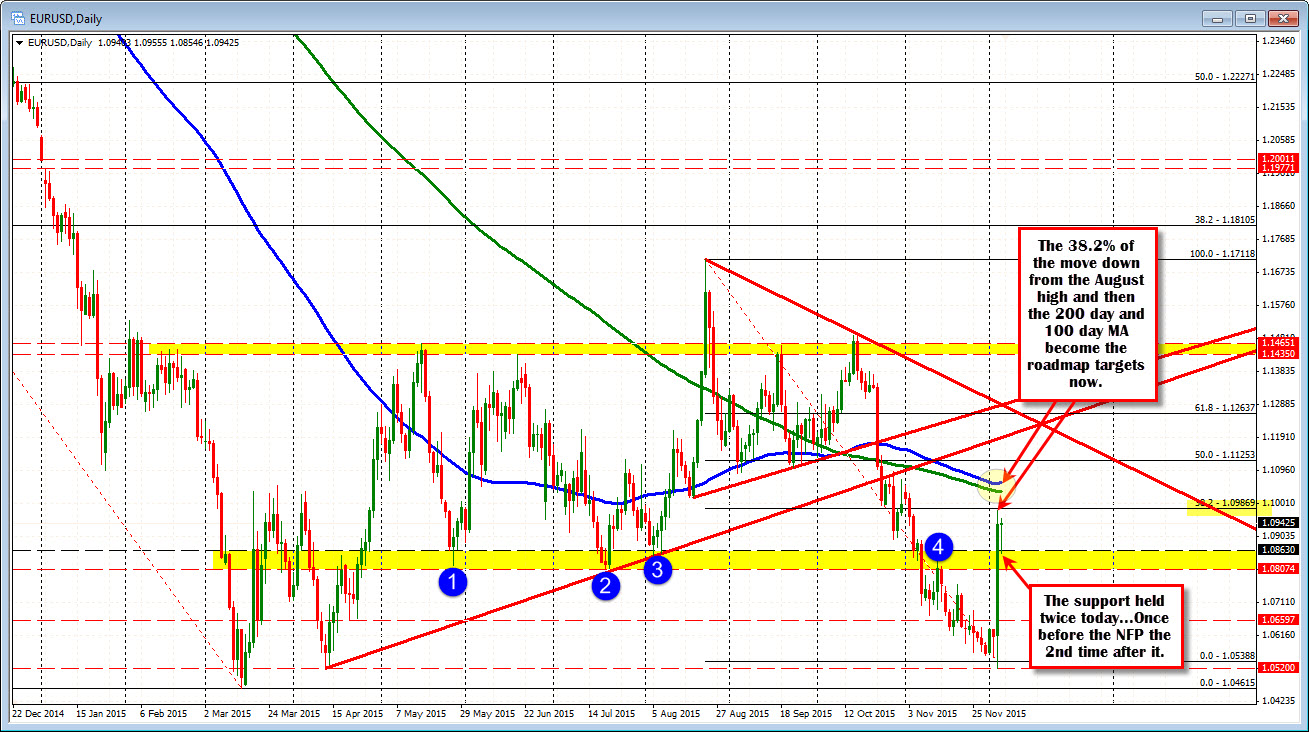

The EURUSD held the support area at 1.0863 on the better NFP report. The Fed will start lift off at the next meeting. The employment picture remains solid with the average gain in NFP this year at around 210K.

The EURUSD ability to hold the upper support level is impressive. I think if you asked 100 traders at the start of the week where would the EURUSD be with the ECB cutting rates, extending the QE, and US employment coming in at 211K with 35K revision, most would not say 1.0940, but that is where where we are currently trading (yes no new ECB QE I know but .....).

What now? Well the support line in sand is set below. with 1.0863 the closest and down to 1.0807 and 1.0790 (see prior post). ON the topside, the 1.09869 level is the 38.2% of the move down from the August high (I moved that up from earlier). The 200 and 100 day MA will be an upside key target. Those moving averages come in at 1.1034 and 1.1060.

For the day, it is Friday, so that brings about flow issues but what seems clear to me is that the buyers remain in control and there may still be some shorts out there who are feeling the pain of a 420 pips surge. Needless to say, there have been buyers on the run up, and speculative shorts make for good buyers if things don't go there way. The chart below shows how the short in the EUR have been accumulating over the last few weeks at a steep pace. So you get a 400 pip reversal and there may be some of those shorts who were looking good, but now don't look so great.