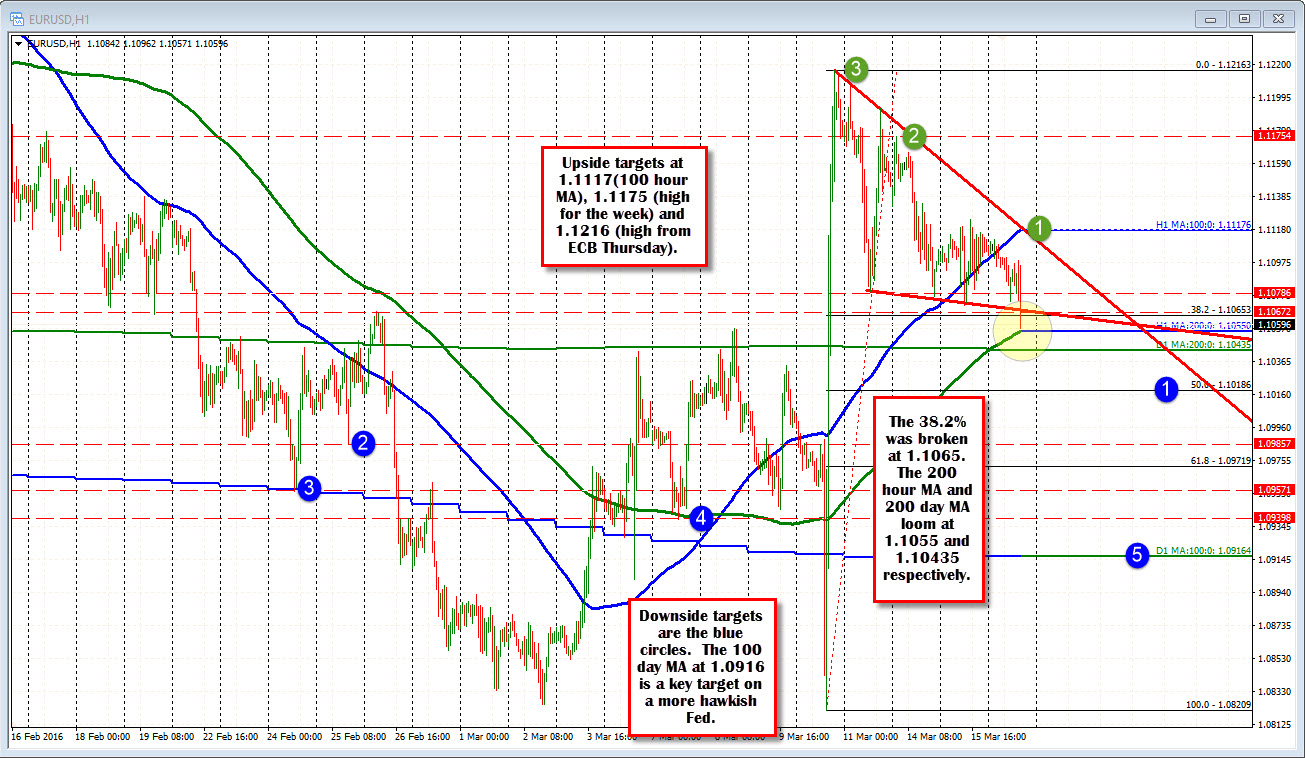

Falls to new week lows

The EURUSD is trading at new session lows/new week lows. In the process the price has moved below the 38.2% retracement of the move up from ECB Thursday low. That level comes in at 1.10653. The 200 hour MA - which has been steadily rising toward the price this week, is on a collision course with price now. That level comes in at 1.1055. A move below that and the 200 day MA at 1.10436 looms. Needless to say there are some key levels that could hold up a more bearish party for the pair - at least in front of the FOMC decision at 2 PM ET.

That decision and statement and press conference are a wild card whose chances of a more hawkish outcome was not hurt by the CPI data at least. If you could ignore the headline YoY of 1.0% and look toward the energy decline of -12.5% YoY as something that will not repeat itself going forward, the inflation picture will even itself up with the employment picture going forward. If wage inflation were to kick in, that would be even better. The problem is that wage inflation has not appeared yet. There is nothing worse than inflation with stagnant wages. Nevertheless, the Fed should look past that anomaly and expect higher wages. Right? Meanwhile, the election process continues with an angry middle class who does not feel any better 8 years from the dead ass low. Crazy times and you can go crazy thinking about the scenarios and all the "Yeah, buts..."

So follow the price action.

Between now and the FOMC decision the market will float with the flows. The bias is for a stronger dollar so far. After? Well with the ECB Draghi fresh in traders minds, the risk will be increased. So be careful.

But on the downside, a move below the 200 day MA at 1.1043 sets up the bears for a run lower (must stay below that line though). Where will it run towards?

- 1.10186 - 50% of the ECB move higher

- 1.09164 - 100 day MA

There are other swing lows (1.0985, 1.0957, 1.0940) that might be of importance on the way down (see blue circles in the chart above)

ON the topside, a break of the 100 hour MA (blue line in the chart above) at 1.1118, opens the door for a move toward:

- The weeks high at 1.1175 and

- The high from ECB Thursday at 1.1216.

On Thursday, while the EURUSD was racing higher, the loudest voices in the comments talked of higher levels. Now the chatter is less bullish. What do you think?