Earlier spike higher now seeing lower highs

The EURUSD spiked on the dollar selling after China said it might look to slow US debt purchases. If they did do that (they would be cutting their own throat as they already own a whole lot of US debt), the thought is they may funnel funds into Europe. Who knows, maybe they would buy US stocks instead. The money has to go somewhere....

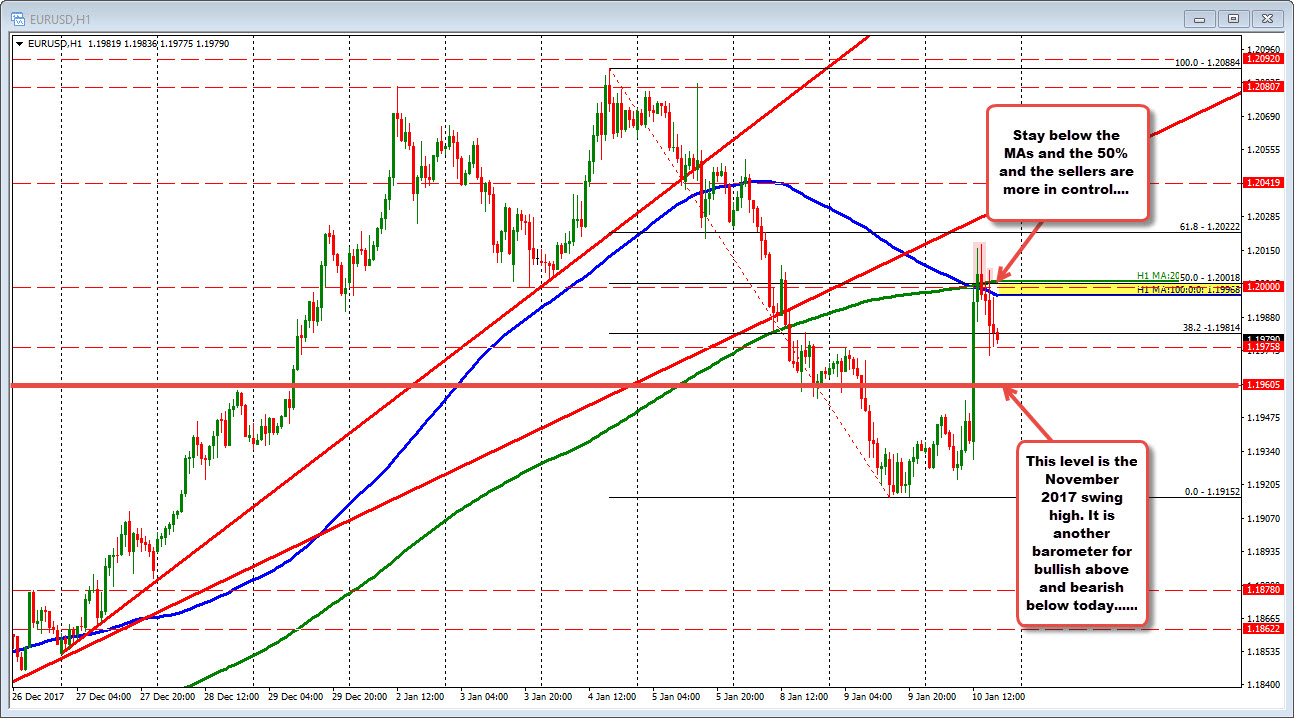

In any case, the headlines sent the price of the EURUSD sharply higher. On the hourly chart, the price took out the converged 100 and 200 hour MAs (at the time - see blue and green lines) AND the 50% retracement of the recent move lower (at 1.20018).

However, the last 4 hours has seen a rotation back down, and the price has closed the last 4 hours below the two MAs and 50% level. Are buyers getting tired? Are sellers entering?

Stay below the 1.2000 area and the bears have the edge. Move above and we could see the buyers coming back in.

What would give sellers more of an edge?

The 1.19605 level was the high price from November 2017. A move back below that level would give the shorts more comfort technically.