Swing high from Oct 26th being breached now

The GBPUSD started to fall yesterday after testing the 100 day MA at the 1.5479 level. The high did extend up to 1.57946 but looking at the chart, the price has had a pattern of extending above that MA (see blue overlay line), only to fail.

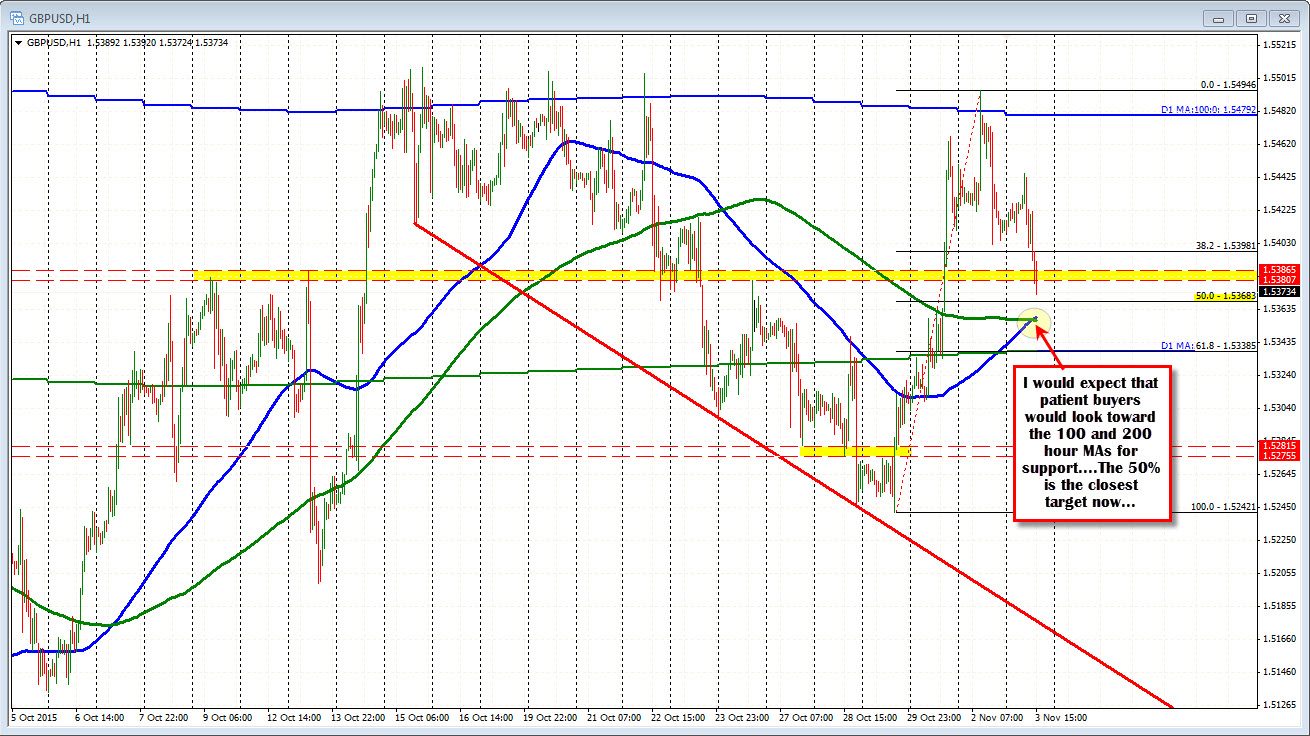

The move today was at first corrective higher but then reversed. The move took the price below the 38.2% retracement of the move up from the October 29 low at the 1.5398 level. It then to test the high price from October 26 at the 1.5380 level. The price decline stalled for a moment at least, but we are currently retesting/moving below that level. The next targets on the downside include the 50% retracement of the same move higher at the 1.5368. The 100 and 200 hour MAs at 1.5357/59 area should also be a key level. Look for buyers against these two MA levels, with stops below as risk can be defined and limited.