BOE more dovish

The more dovish BOE decision, has sent the GBPUSD tumbling lower.

Technically, it turned the bias back to the downside. The EURGBP has also pushed sharply higher.

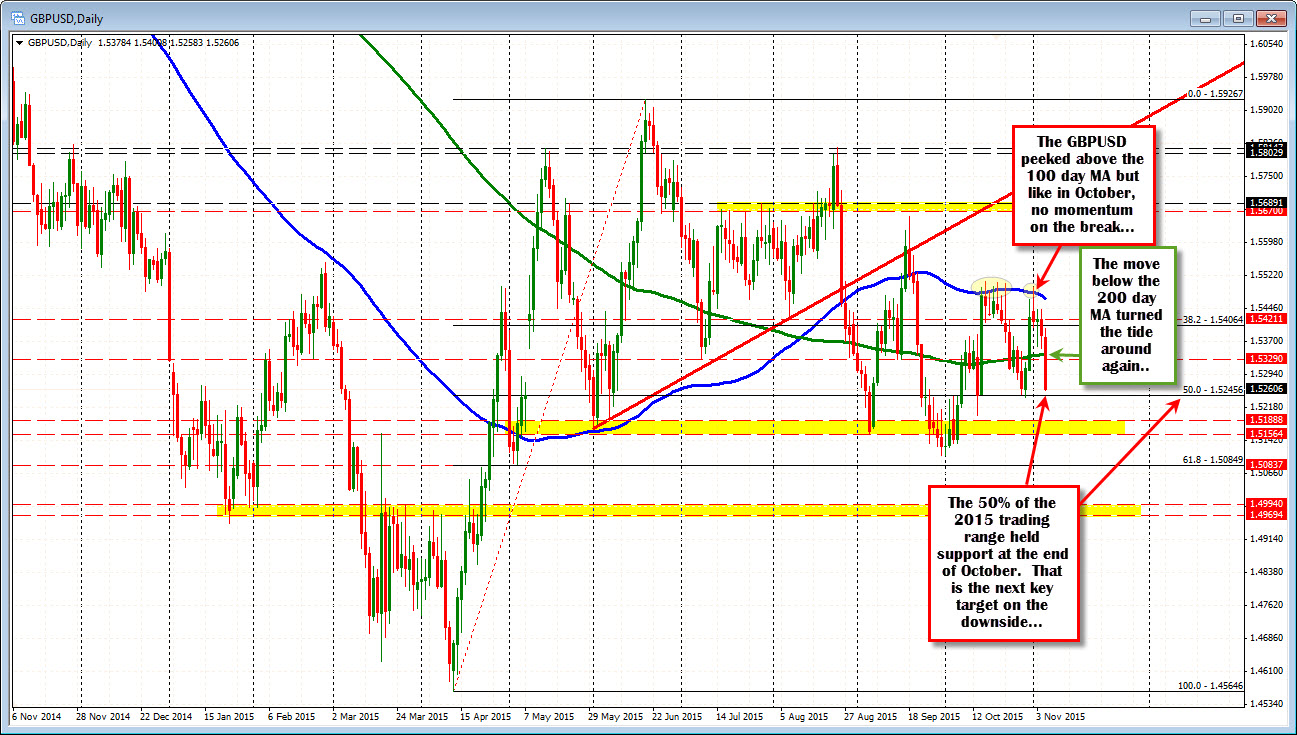

For the GBPUSD, the price fell back below the 200 day MA at 1.5340. The price of the pair surged higher last Friday and peeked above the 100 day MA (blue line in chart above) on Monday (in October it had five separate looks above the MA - but each failed).

The dollars strength then took over and the price started it's move lower - but remained above the 200 day MA (green line) - until the decision today. That 200 day MA had no chance, although looking at the 1-minute chart below there was one small corrective move to 1.5332 before the next shoe fell (the 200 day MA is at 1.5340). Sellers were anxious to lean against the 200 day MA.

Do they remain anxious and keep the pressure on?

When the market moves so quickly, and turns the beat around, it is about keeping the bias in the direction, and getting through the next targets.

What keeps the bears happy (and the buyers really nervous)? Keeping the pressure on.

Looking at the minute chart, the 1.5299 level was broken, tested and fell to a low. The correction off that low came to 1.5299 and held again. A new low was made. SO traders who got in late are short below 1.5300. That is a ceiling that keeps the sellers happy/the dip buyers uncomfortable.

What about targets? Well, revisiting the daily chart, the 50% level at 1.5246 was tested at the end of October. It needs to be broken and stayed below in November if there is more room for a further fall.

Selllers in charge below 1.5300. Get through 1.5246 and then look to stay below that level. That keeps the beat turned around....