...it needs to move...

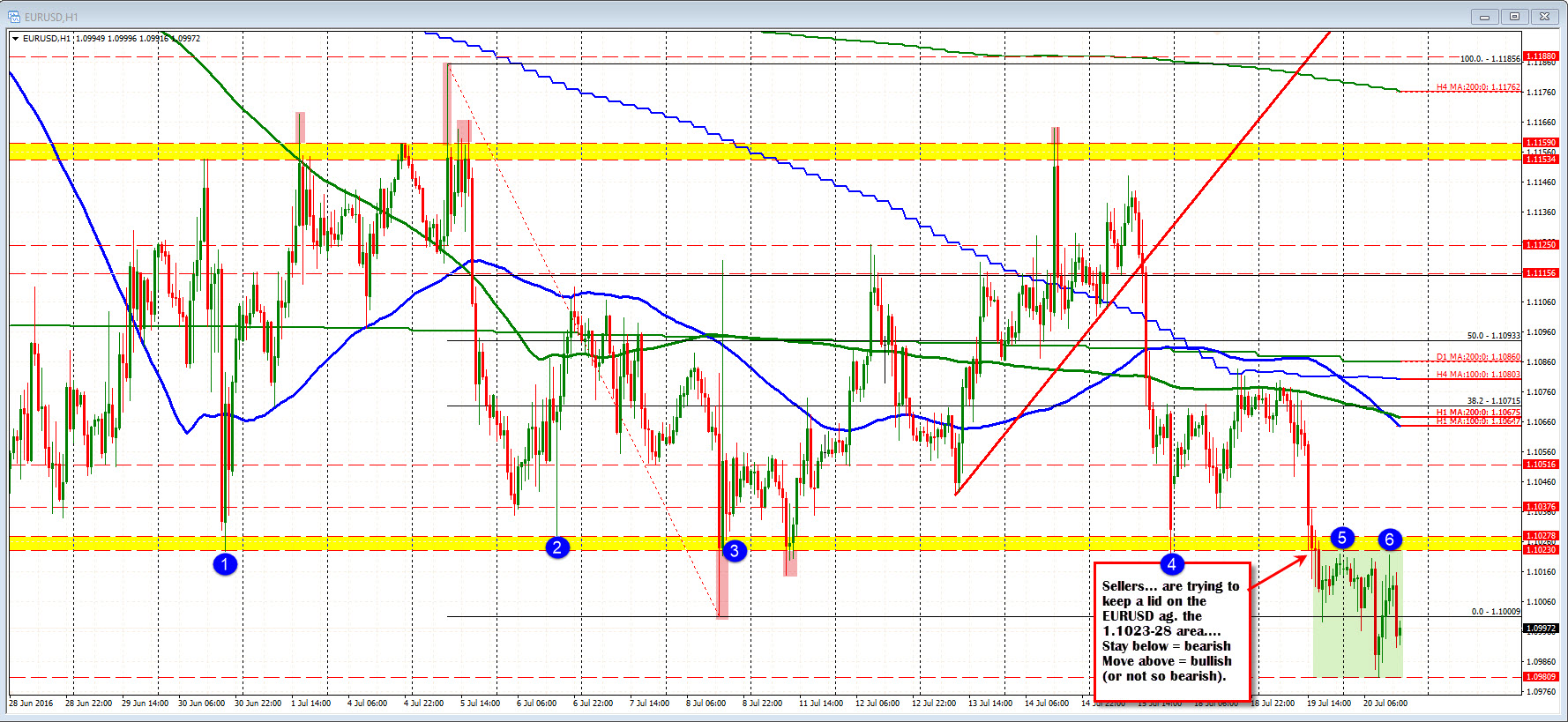

On Monday, the EURUSD held resistance against a bunch of MAs. I talked about that level in the weekend video.

ON Tuesday, the price fell below the lower extreme at the 1.1023-28. Yes... we traded lower on July 8 and July 11 and even a little tiny bit on Friday's late Turkey coup sell off (see red shaded areas in chart above). BUT...The low close going back to June 28 on the hourly was 1.1024. The low on June 30 was 1.1023. The falls below that area could not sustain the selling. That is the area that is/was the floor.

"Was" the floor because today it is acting like the ceiling. The high price reached 1.10215. Sellers are leaning against the level....Leaning against the ceiling. That defines the level as an even more important level going forward (stay below bearish).

That is the bearish news.

The not so bearish news is let's face it....the EURUSD has traded in a narrow 136 pip trading range for most of 16 days. That is narrow. That is a long time (a vast majority of trading has been between 1.1023 and 1.1159). The BREAK of the 1.11023 level has pushed "all the way" to 1.0981. Whoop de doo. Come on traders....trade. Push it!

We are currently trading back below the 1.1000 level (good for the bears). The range for the day is 41 pips. If the sellers want to go lower - even if it is just technically (your risk is above 1.1028 "big boys") - push it.

Next targets 1.0970 (Low from June 27), 1.09377 (61.8% of the move up from December) and 1.0910 (low from June 24th). Come on traders....push it.