Claims weaker. Productivity up but wages not

The US data showed that initial jobless claims were higher (weaker) for the current week. Although the data point was weaker and the 4-week MA moved higher, the number is still indicative of a healthy job market.

On the productivity side, a bit of a mixed bag. Productivity was much better than expected but the wages lagged. Will wages catch up as the employment picture tightens or is there a structural problem with job creation (lower paying jobs are where people are forced to go).

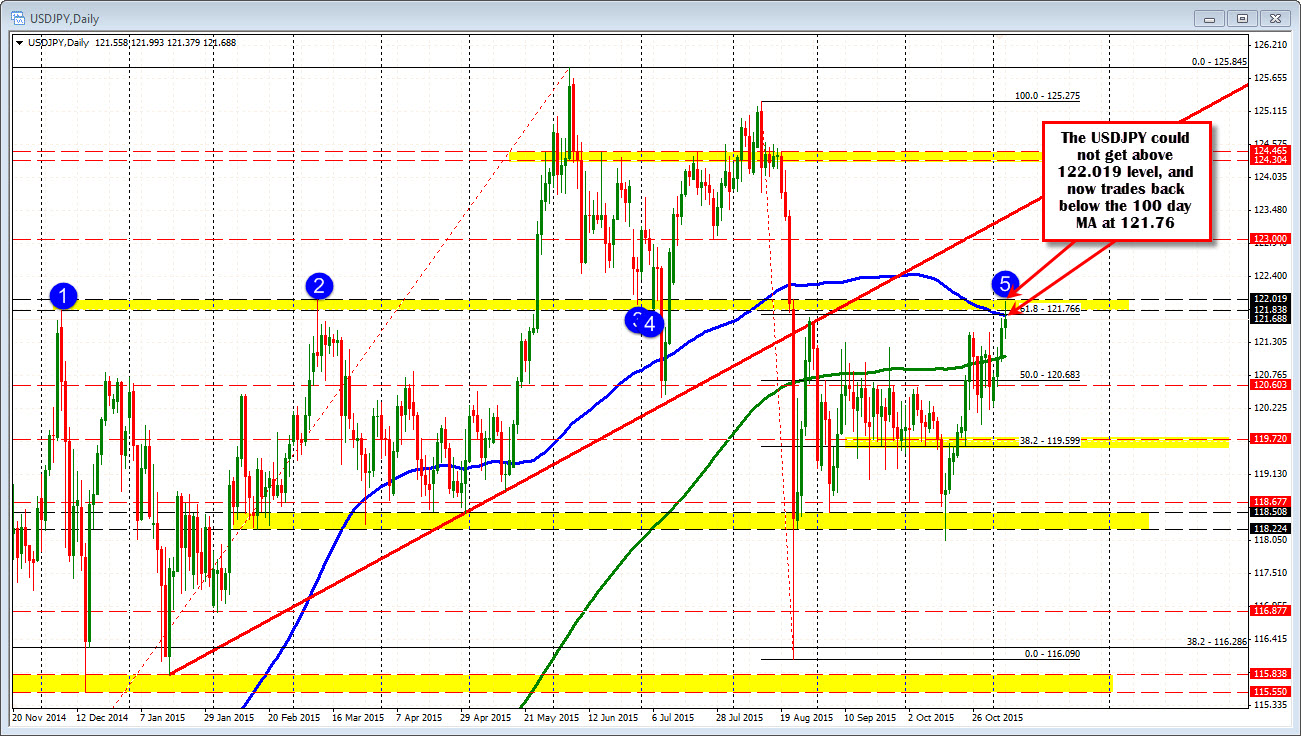

The USDJPY has moved lower off the mixed bag of data and trades back below the 100 day MA at 121.758. Earlier today, the pair moved above this MA for the first time since August 21. The price high today could not get above the 122.02 level (swing high from back in March). A move above that level would have given a more bullish view for the pair, but it was not to be - at least for now.

Looking at the hourly chart, the break above the 100 day MA was bullish but the topside channel trend line got in the way. The move lower will now look toward the lower channel line at the 121.50 for support.

The first look above the 100 day MA since August was a flop for the buyers. With employment in the US the next major event, traders may take the failure as an opportunity to take some profit after the move higher and await what needs to be a great number to keep the dollar buying going. With the BOE being more dovish today, the Fed lost an ally in the tightening idea. That will likely make it more difficult for the Fed to pull the trigger absent a really good number tomorrow.