A pocket of dollar weakness

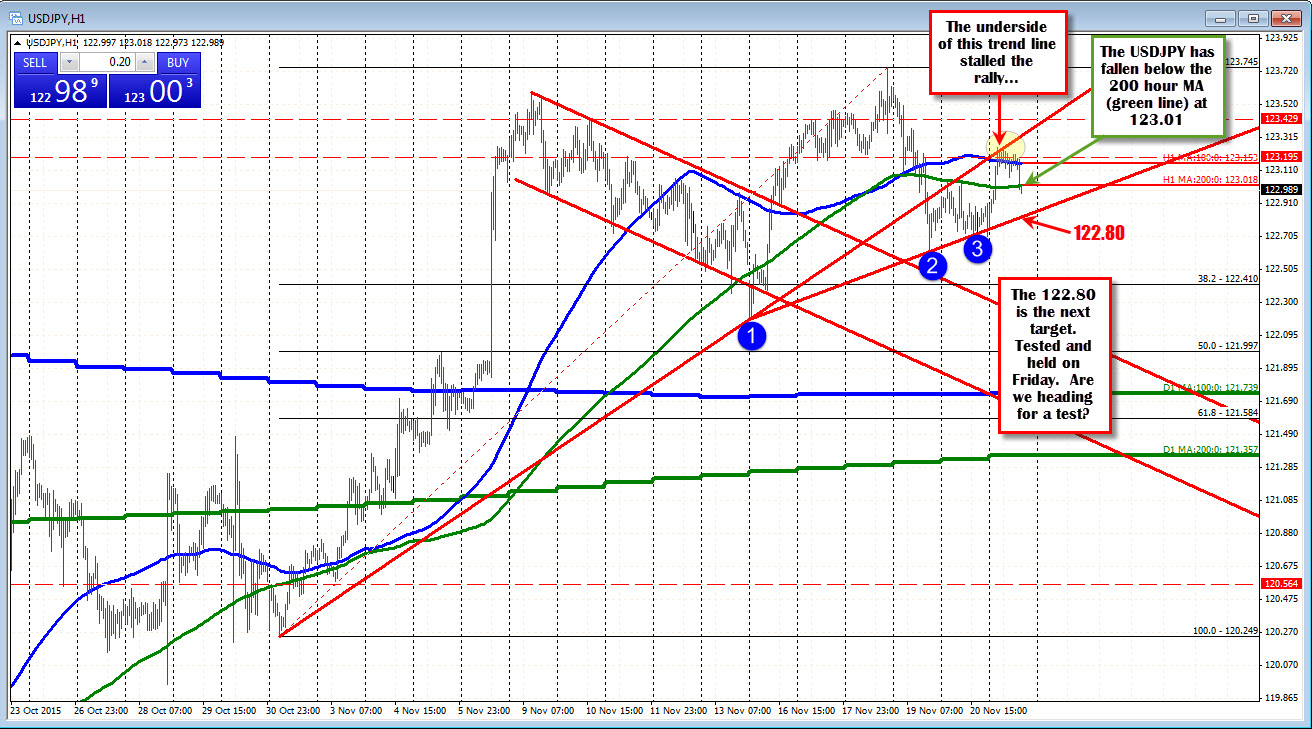

There has been a pocket of USDJPY weakness in the last 1/2 hour or so of trading in the USDJPY and that move has pushed the price back below the 200 hour MA (green line in the chart below) at the 123.018 level. The price fell below the 200 hour MA on Thursday of last week, stayed below it on Friday (test held). The dollar strength in the early hours of trading today, pushed the price back above both the 200 and 100 hour MAs (green and blue lines) but stalled near topside trend line. With support holding a lower trend line on Friday and at the opening today, traders seem to be marking their territory above and below. Sell high. Buy low....for now.

The price fall back below the 200 hour MA should solicit more selling with the 122.80 trend line the next target. If the break fails,ultimately, the pair will need to move above both the 100 hour MA at 123.15, and the underside of that broken trend line at 123.32 (and stay above).

On the downside, the lower trend line break at 122.80 will have traders looking to get below the Thursday low at 122.61 to then target the 38.2% at 122.41.

The price action is getting confined. When the price is in the middle of a range - the midpoint of the range since the US employment surge on November 6th comes in at 123.96 - there tends to be different levels to contend with both on the topside and the downside.

Most likely believe that the overall dollar bias is bullish as the Fed tightening is becoming more and more accepted. Also the pair remains above the 100 day MA at 121.73. However, what is priced in could solicit some further corrective action. Intraday, the fall back below the 100 and 200 hour MAs has traders leaning toward some further downside probing for that key support level.