US stocks to come

The USDJPY tumbled in trading yesterday with sharp declines in US stocks and bond yields helping to weaken the USD and send flows into the "relative safety of the JPY" pairs (including the USDJPY). The range was about 238 pips - well above the 22 day average of 94 pips. The pair lost close to 2% on the day.

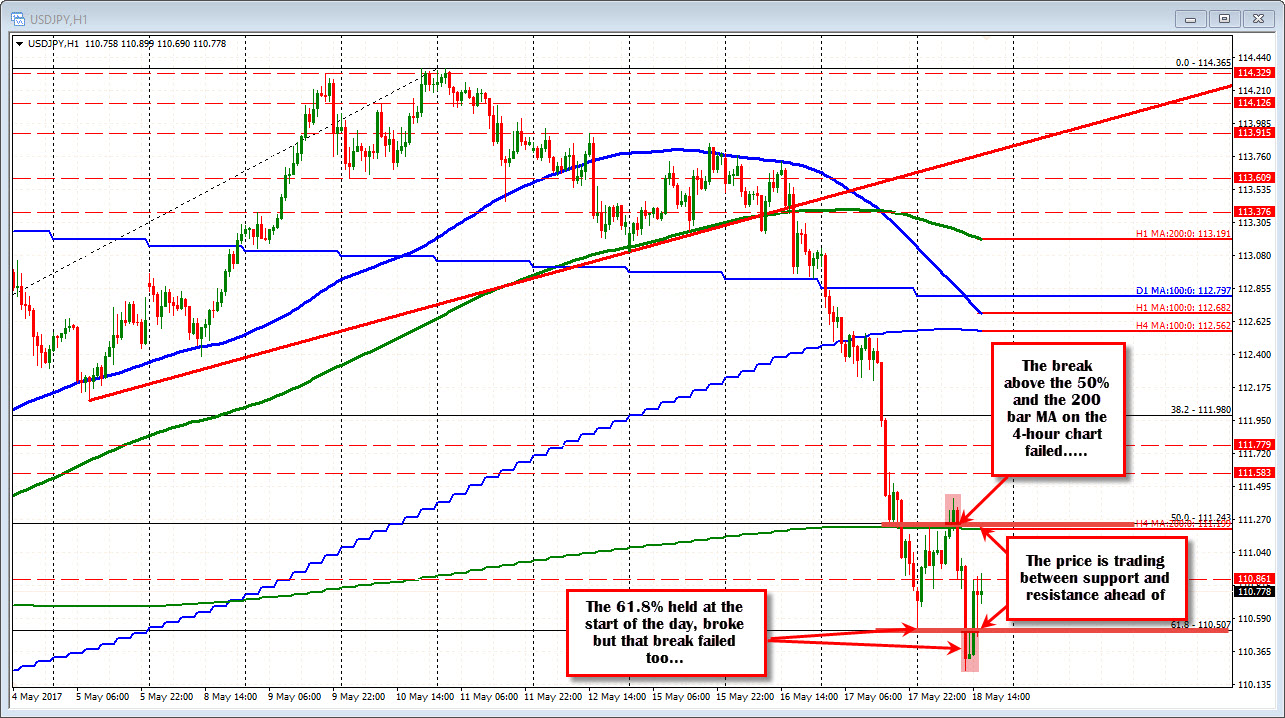

The USDJPY found support in the early Asian session today at the 61.8% retracement of the move up from the April 17th low. That level came in at 110.507. In the London session as stocks fell in Europe and the US open came closer, the pair fell below the 1.10507 level.

However, the better US data this morning (claims still supportive of US employment gains and the Philly Business index a strong beat), has helped to push the pair back higher.

Nevertheless, the buyers have some pretty good resistance above if shorts are to cover. Specifically, the 50% of the move up and the 200 bar MA on the 4-hour chart comes in at the 111.20-24 area. Yesterday, the level held support for a few hours before breaking. Today the corrective move first stalled at the level, and then did manage a move back above. However, that move failed.

WIth the price still below the 111.00 perhaps it is premature to speak to the level. However, despite the move above earlier today, I look at the level as a key level for traders. Stay below and the bears are in control. Move above and the winds of change might be blowing.

US bond yields are lower but off the lows. The 10 year yield is down 1.2 bps now at 2.212%. The low reached 2.1791%, close to the low from April at 2.16%