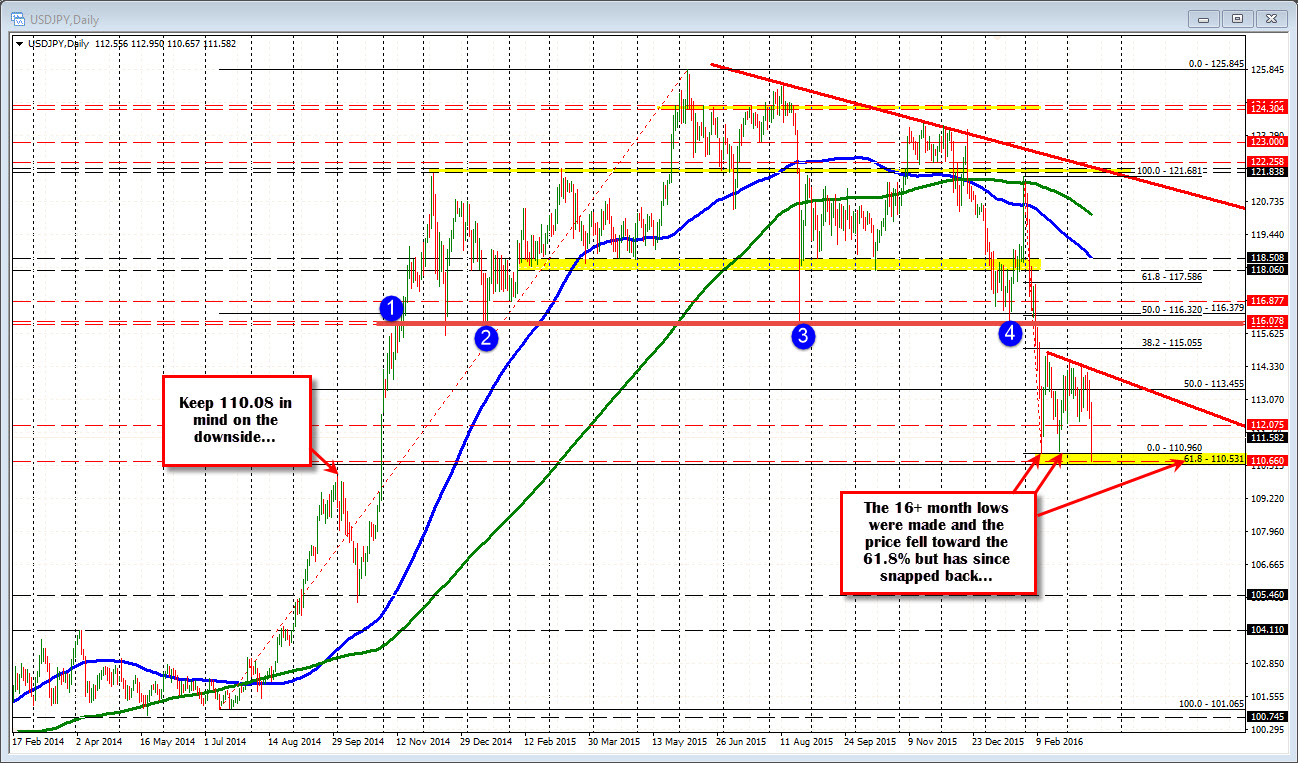

Tests 61.8% retracement level

The USDJPY continued the sharp fall today and pushed below the lows from February at 110.96 and 111.03. The break to new year and 16+ month lows triggered selling down to the 110.66 level. The 61.8% retracement of the move up from the July 2014 low was not far away at 110.531.

That break failed, and we have seen a snapback rally that is taken the price up 133 pips. Looking at the 5-minute chart below the price has been consolidating above and below a trend line and the 100 bar MA. The 38.2% of the move down from the pre-FOMC high was breached at 111.86 on the quick move higher. Should there be another run above that level we should see continue momentum toward the 200 bar MA (green line in the chart below) at the 112.13 area.

Right now there is more two-way flows at the MA and trend line level as traders battle it out at the corrective resistance area.