100 and 200 hour MAs contain the pair during European session

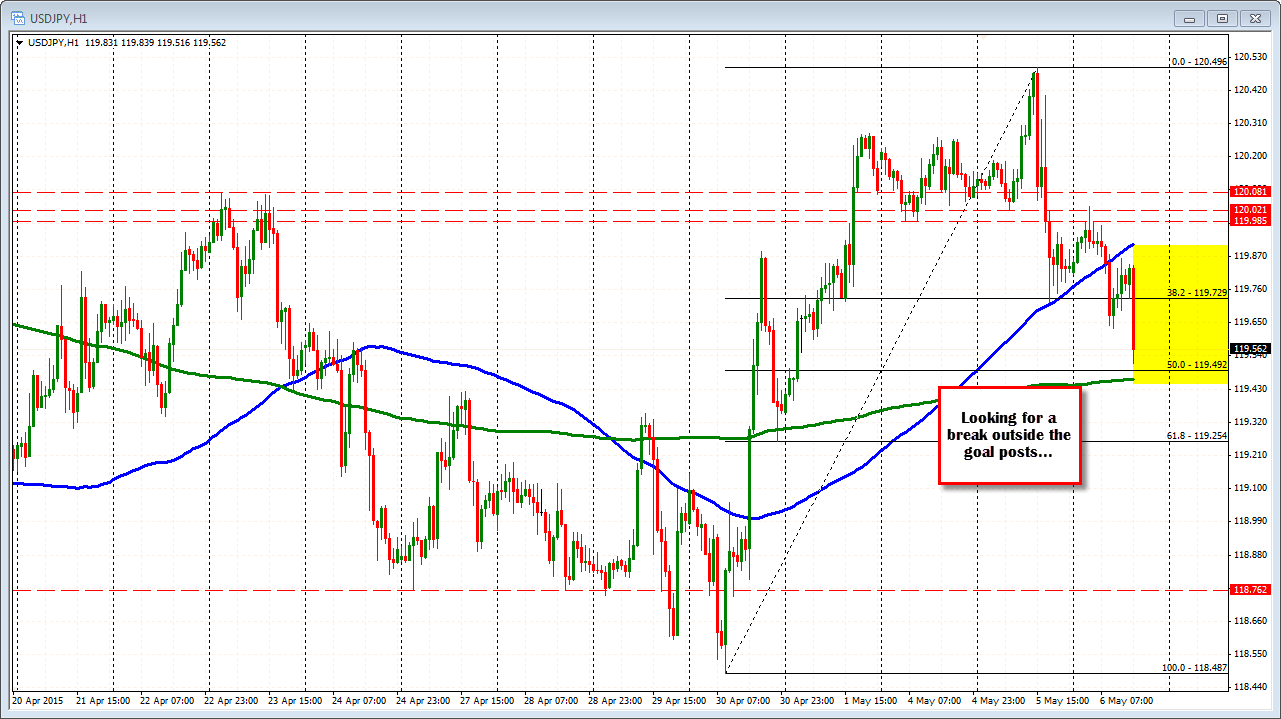

The USDJPY fell below the 100 hour MA during the early European trading session and has been able to stay below that MA line (resistance). Below is the 200 hour MA (green line in the chart below) at the 119.46 level The 50% of the move up from last weeks low comes in at the 119.49. I call this trading between the goal posts with the 100 and 200 hour MAs defining the range. Traders can use the levels to define and limit risk - until the break.

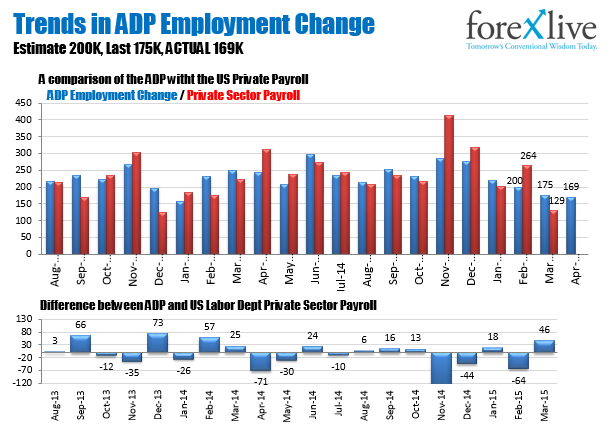

The data today showed weakness in the ADP (169K vs 200K est). The ADP is supposed to track the private sector payroll change but the chart below shows spotty success in doing that. Nevertheless, if the change in private payrolls is expected to be 225K, it is still possible but there have only been 3 times the difference has been greater over the last 20 reports. So the downside should be the easier way but understand that I do not expect a run away trend. There may be traders line up on any move higher, however with a stop above the 100 hour MA.

The wild card today is Yellen (at 9:15 AM ET). This will be her first chirps since the FOMC statement last week. She will be on a panel discussion but is not scheduled to talk about monetary policy. However, a panel discussion can go many ways. The market will be all ears to hear if she has altered her thoughts on tightening bias and when - although data dependent and sometime in 2015 might still be her words of choice.