Raced higher in early NY trading

Mike pointed out the that CHF pairs (USDCHF and EURCHF in particular) have made a run to the upside. Is it SNB or fear of the SNB (CLICK HERE)? Retail traders won't know until after the fact (and even so it might be speculation). However, the technicals also helped to confirm a bullish move.

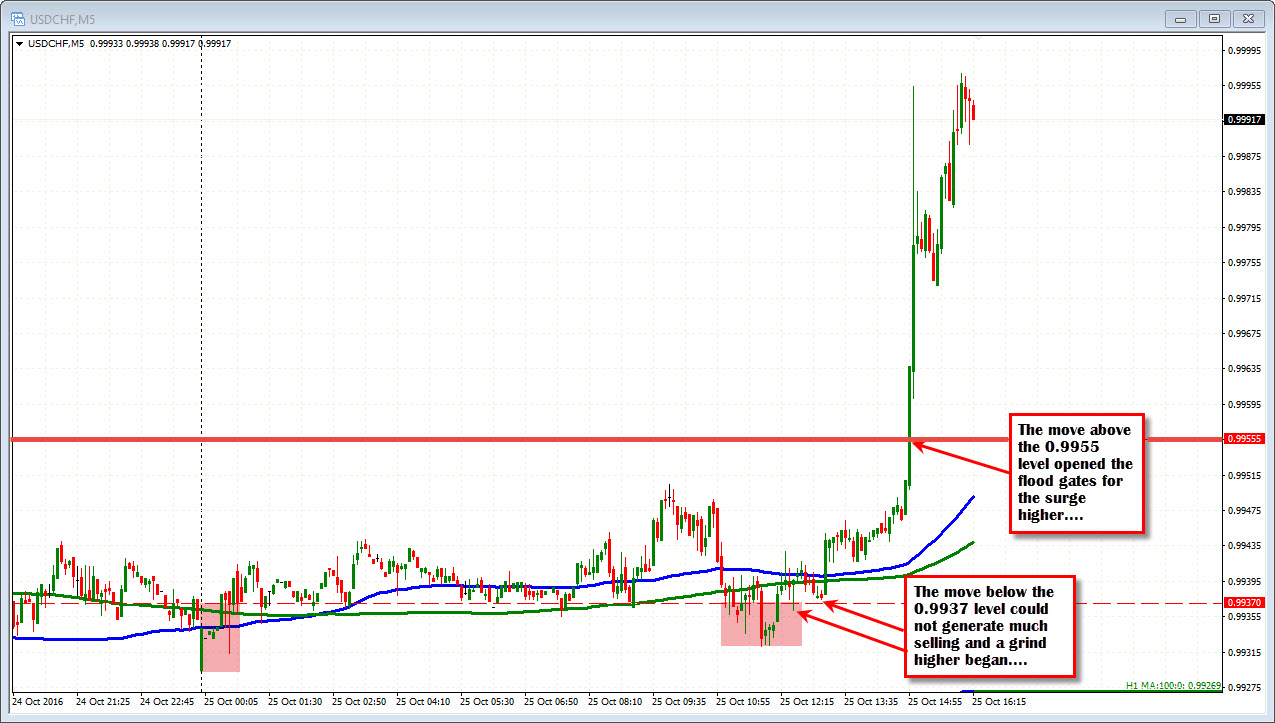

For the USDCHF, looking at the daily chart, the pair moved above trend line resistance over the last few days but was finding additional sellers against highs from May and July at the 0.9949-55 area.

Today, the corrective low moved below that trend line at the 0.9937 level but only for brief moments (see 5-minute chart below). The price started to rebound slowly higher. Note what happened on the move above the 0.9949-55 resistance highs? That was the trigger for the sharp spike higher.

For the EURCHF, the ppair fell below trendline support over the last few days (today the line came in at 1.0817). However, the 1.0788-1.0800 was key floor area. Traders leaned against that level in anticipation that the SNB might defend it. Whether they did or not is not really known, but we know support held.

The move back above the trend line at the 1.0817 level, helped to give the buyers more confidence and with the help from the USDCHF break, the EURCHF also made a break to the upside (see 5- minute chart below).

What now?

For the EURCHF, the pair has run into some resistance against the 200 hour MA at 1.0855. The price moved above the line (see green upper MA in the chart below), but has found some sellers against it. The correction lower has moved to the 38.2% of the trend move higher today. SO buyers remain in control. Nevertheless, a move above the 1.0855 will be eyed now.