Chatter of deals and production cuts increases but is it real or just more bluster?

The saying there's no smoke without fire could be applicable to oil markets right now. We've been hearing calls for OPEC to hold emergency/extraordinary meetings for months. It's natural for countries seeing their incomes drip through their fingers, as the price of oil falls, to start getting grouchy. Nigeria were at it a week or so ago and they were at it this time last year too.

The difference I'm seeing right now is that the talk is becoming more widespread and involving bigger and bigger names. That might be enough to keep any real downside moves limited.

The crunch time for the bear trend will come when the Saudi's come out with news of a deal with non-OPEC producers or production cuts (either alone or via OPEC). When that happens obviously oil will fly

One thing to think about when producers moan about prices is that they are able to hedge their positions up to four years out in futures markets. If any of them were sensible to hedge out that far one or two years ago, they are locked in to prices much higher than here. If we take it from the 2014 drop from $115+ then producers could still be sitting on hedges that have two years left to run and have their incomes protected for that period. If they rolled out as every new contract opened then their profits are further protected, although they would be diminishing.

Even taking the ICE Dec 2020 contract, it's trading up near $50, which still gives a very good margin.

The long and short is that the pain for producers may not be as great now, or over the next year or two, as people fear, IF they've hedged themselves appropriately.

What is certain is that the pain levels increase the longer this bearish sentiment remains and prices stay down trodden. The only real way prices will rise is with firm committed action.

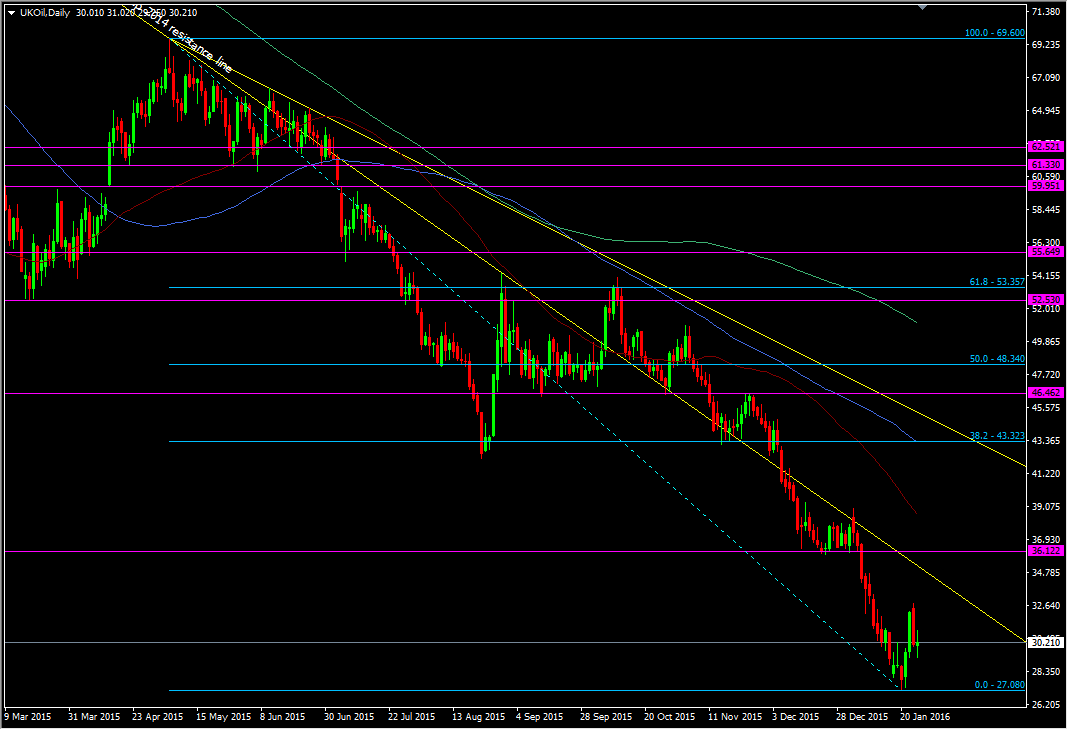

For prices now, there's a lot of room to roam. If we just take the May 2015 move down in Brent, the 38.2 fib is way up at 43.32

Brent Crude daily chart

While I say "way up", oil prices can rip that in a couple of sessions and we must always remember that.

I would like to dip into oil longs if we fall down to $25 or less but may have to be prepared to wait it out and that could mean paying the price of rollovers. Trading further out in futures obviously increases the risk from being in at higher prices.

There's definitely something brewing in the producer world so we need to be on our toes so make sure you're in control of you positions and it's not the other way around.