US CPI to be released at 8:30 AM ET/1230 GMT

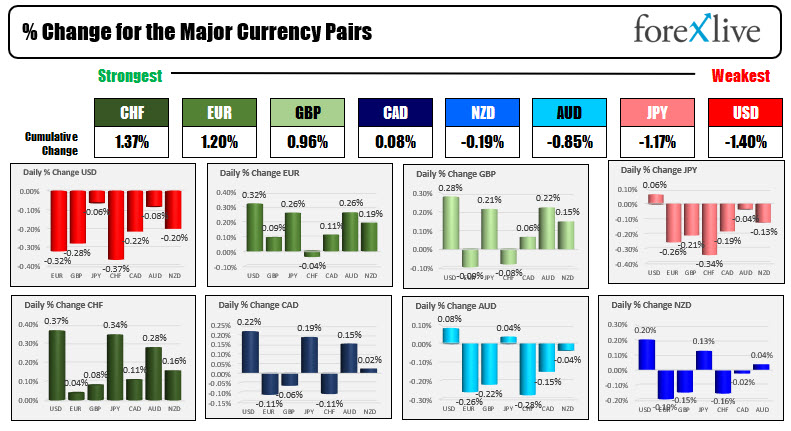

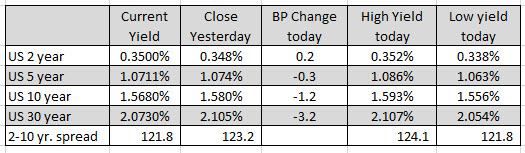

The CHF is the strongest and the USD is the weakest as the North American session begins. The US CPI will be released at the bottom of the hour with the expectations that the month CPI will rise by 0.3% with the core up 0.2%. Both the YoY measures are expected to remain elevated at 5.3% for the headline and 4.0% for the core. The the US stocks are higher in premarket trading after erasing earlier losses. J.P. Morgan kicked off the earnings calendar by beating on their estimates. There stock is currently up 0.8% in premarket trading. US yields are lower ahead of the 30 year bond auction at 1 PM ET. That issue is currently down -3.2 basis points at 2.073%. The yield curve is flatter.

In other markets:

- Spot gold is up $16.66 or 0.95% at $1776.40

- Spot silver is up $0.35 or 1.56% at $22.89

- WTI crude oil futures are trading down $0.60 or -0.74% at $80.02

- The price of bitcoin is down $-667 or -1.19% $55,327

In the premarket for US stocks, the major indices are higher after trading lower overnight. The major indices are on a three-day losing streak. Apple announced at the close yesterday that they were having problems with chip shortage which may reduce iPhone sales. That stock is lower in premarket trading. J.P. Morgan shares are higher after reporting better earnings and kicking off the earnings calendar:

- Dow industrial average up 63.66 points after yesterday's -117.72 point decline

- S&P index is up 8.6 points after yesterday's -10.56 point decline

- NASDAQ index is up 70.65 points after yesterday's -20.28 point decline

In the European equity markets

- German DAX is up 0.75%

- France's CAC is up 0.3%

- UK's FTSE 100 is down -0.1%

- Spain's Ibex is down -0.45%

- Italy's FTSE MIB is unchanged

In the US debt market, the yields are mixed with the flatter yield curve. The 30 year issue is trading down -3.2 basis points at 2.073%. The treasury will auction of 30 year bonds at 1 PM ET. The two year yield is up 0.2 basis points. The two – 10 year spread is flatter by 1.4 basis points to 121 point basis points from 123 42 basis points.

In the European debt market, the benchmark 10 year yields are also lower with UK yields down -4.5 basis points. The German yield which reach day high yield today is -0.085% has moved back lower and trades at -0.122%.

Also on the calendar today is the FOMC meeting minutes will be released at 2 PM ET.