September 6, 2017 snapshot as North American traders enter for the day

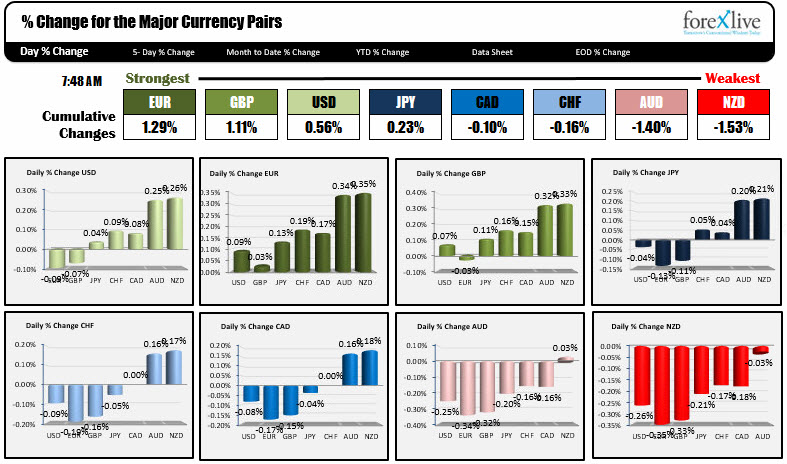

The snapshot of the strongest and weakest currencies shows that the EUR is the strongest currency while the NZD is the weakest. The USD is mixed with the USD lower vs. the EUR and GBP but up modestly against the JPY, CHF, CAD and with larger gains vs the NZD and AUD.

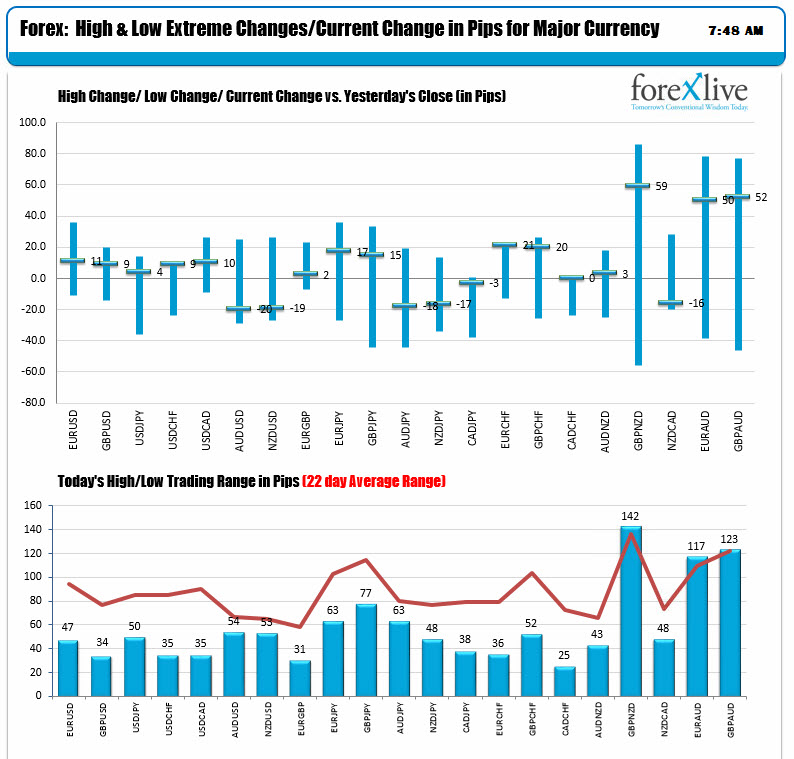

Although the EUR is the strongest today, the EUR was the higher - indicative of an up and down market. The EURUSD was up near 38 pips on the day. It is up only 11 now. The EURGBP has also retraced most of it's early gains as well (see charts below). The ranges are narrow with most of the major currency pairs and crosses a good distance away from their 22 day averages.

On the data front today, the trade data in Canada and US will be released at 8:30 AM ET/1230 GMT. The Markit PMI data for services and composite will be released at 9:45 AM ET/1345 GMT. At 10 AM/1400 GMT, the BOC will likely keep rates unchanged (although there is a potential hike too) along with ISM non-mfg composite in the US (55.6 vs 53.9 last). Later this afternoon, the Fed will release their Beige Book assessment of the US economy.

A snapshot of the other markets shows:

- Gold unchanged at $1339.51

- WTI crude oil is up $0.57 to $49.23. Hurricame Irma is bearing down on US and that could impact oil drilling rigs in the Gulf of Mexico impacting supply.

- The US stocks in pre-market trading are up with the S&P futures up 3.25 points. Nasdaq futures up 14.75. Dow futures up 31 points.

- The US yields have moved higher over modestly. Yesterday yields tumbled by up to 10 bps. Today: 2 year yield 1.290%, unchanged. 5 year 1.6512%, up 1 bp. 10 year 2.0715%, up 1.2 bp. 30 year2.6897%, up 1 bp

- In Europe stocks are mixed. Dax up 0.5%. Cac unchange. UK FTSE down -0.4%. Spain Ibex down -0.3%

- European 10 year yields are little changed. Germany unchanged. France up 1 bp. UK down 1.1 bp. Italy unchanged. Spain up 1.8 bp. Portugal unchanged.