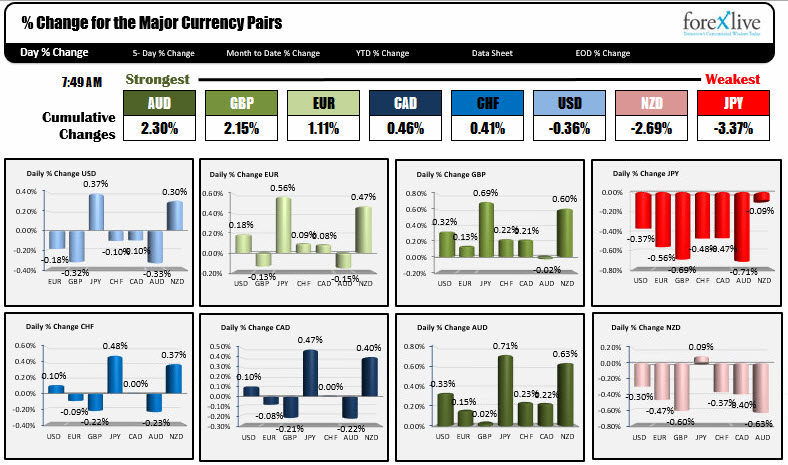

The AUD is the strongest. The JPY is the weakest.

As the NA traders enter for the trading day, the AUD is the strongest while the JPY is the weakest. Australia's new home sales were stronger at 1.1% and commodities were higher in the session. In Japan retail sales were weaker than expectations, but the USDJPY got more of a boost in the European session. US yields are higher (along with European yields). That tends to support the USDJPY. The 10 year US note is up 5.2 bp. The German equivalent note is up about 7.8 bps. Despite the rise in yields, the USD is mixed with gains versus the JPY and NZD and losses against the EUR, GBP, AUD. The CHF and CAD are little changed.

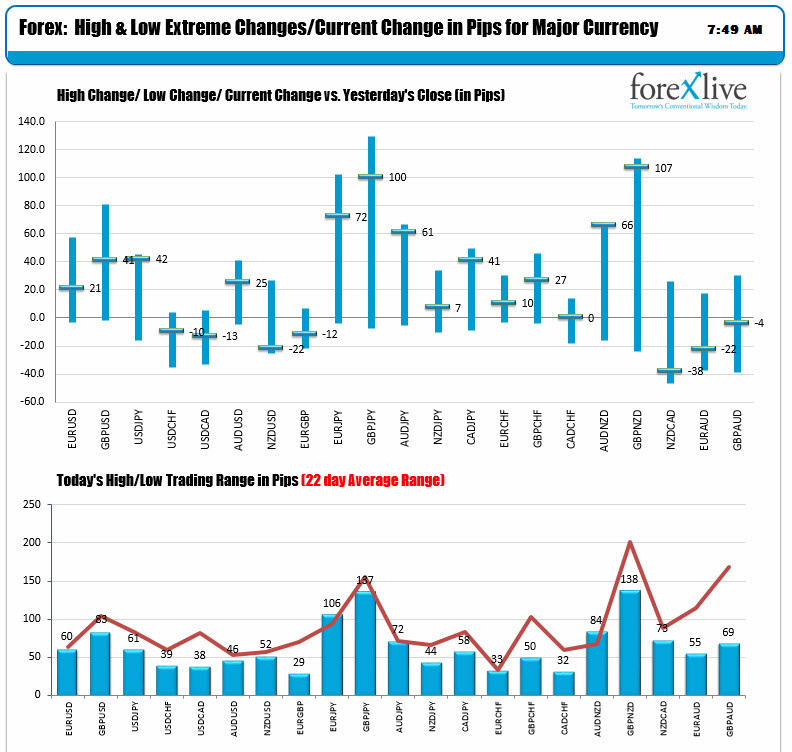

Looking at the changes and ranges, the USDJPY, EURJPY, AUDJPY, CADJPY and GBPJPY are trading at, or near, the highs. They are leading the activity today. Looking at the trading ranges vs. the 22 day averages (about a month of trading), the ranges are ok but most of the pairs are still below the average.

In other markets, the snapshot shows:

- US yields are higher. 2 year 1.365#, up 1.1 bp. 5 year 1.865%, up 4.4 bp. 10 year 2.280%, up 5.2 bp. 30 year 2.826%, up 4.5 bp.

- US stocks are mixed. Nasdaq futures are down -16 points. Dow futures are up 30 points and the S&P futures are up 4.2 points. Banks were given the go ahead to increase dividends and buybacks and most are trading higher in pre-market trading.

- Spot gold is down -$4.50 to $1244.74.

- WTI crude oil i s up $0.55 or 1.23% to $45.29.

On the economic calendar:

- Initial jobless claims are expected to stay steady around last weeks 241K (est 240K)

- US GDP (this is the 3rd estimate and we are almost done with the 2nd quarter) is estimated to come in at 1.2% vs 1.2% last. Personal consumption is also expected to be unchanged at 0.6%.