October 22, 2015

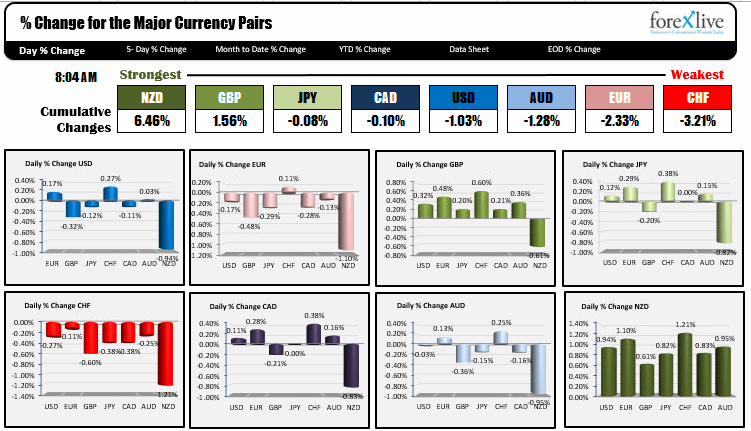

The strongest currency as North American traders enter for the day is the NZD. The weakest currency is the CHF.

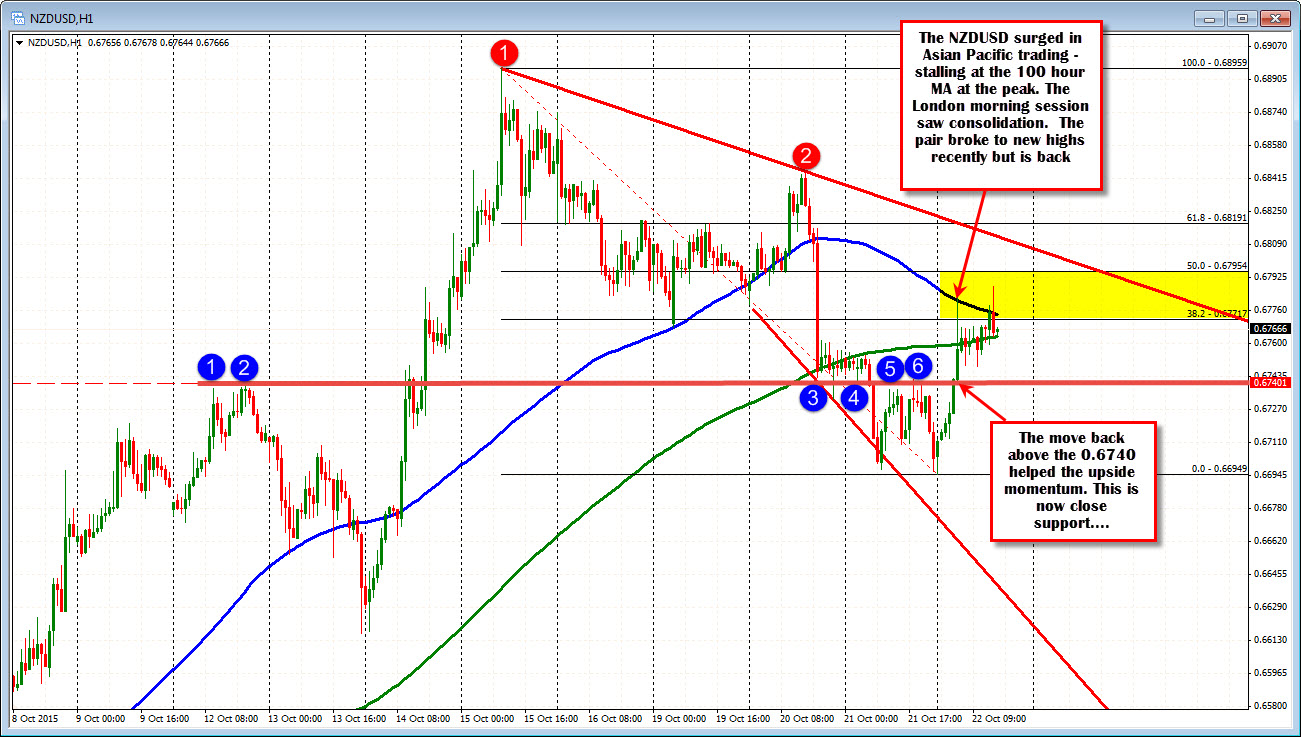

The NZD was helped by a comment from FM Engligh who said that the Kiwi $ had adjusted considerably already. The NZDUSD moved above 0.6740 area (prior resistance and then support) and saw a rapid gain on stops before some stabilization against the 100 hour MA (see chart below). The pair has been consolidating in the London morning session.

The snapshot of the USD is mixed with the dollar rising against the EUR, CHF and AUD, but falling against the GBP, JPY, CAD and the NZD.

The EUR is down against all the major currencies with the exception of the CHF before the Draghi presser at 8:30 AM ET.

The GBP gained vs all pairs with the exception of the NZD as better retail sales propelled the currency higher.

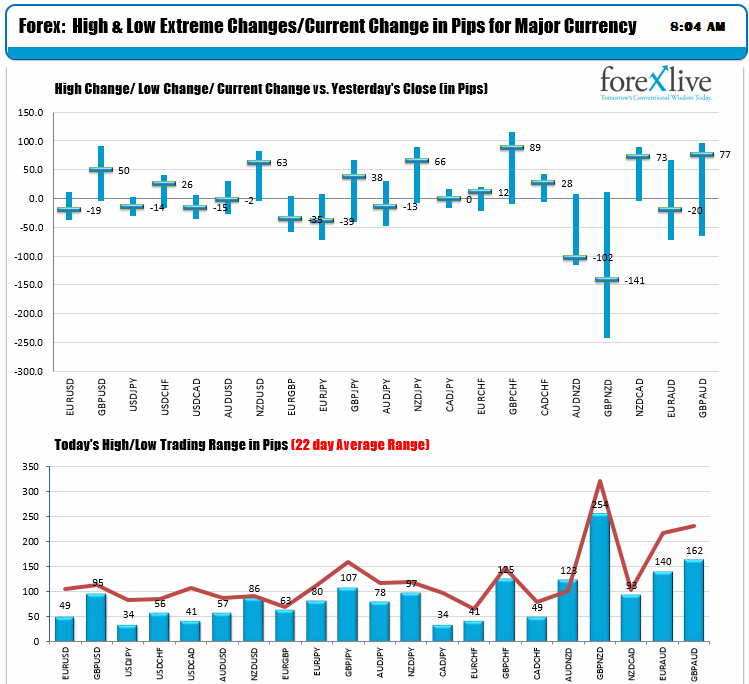

Ranges remain more subdued as compared to their 22-day averages (about a month of trading). The EURUSD has a 49 pip trading range vs a declining 22 day average of 93. The weeks range (working on the 4th day) is only 86 pips. The uncertainty from central banks continues to sap volatility from the forex market.

In addition to Draghi, the Chicago National Activity index (-0.20 est) and weekly jobless claims (265K est). will be released at 8:30 AM. In Canada retail sales ((+0.1 est. and +0.2% ex auto) will be released. At 10 AM ET, US existing home sales are expected to rise to 5.39M pace in Sept. vs 5.31M in August. The high water mark for 2015 has been 5.48M pace in June. The US Leading index is expected to come in at 0.0% vs +0.1% last month.