Key technical test...

The USDCHF has moved up on the back higher today after the sharp fall on Friday. On that day, the CHF was the beneficiary on the flight to safety on the back of the Flynn news and concerns about the Senate tax reform vote. Over the weekend, the Flynn news was less damning for the President AND the tax reform was indeed passed.

The "flight into safety" from Friday, turned to the "flight out of safety" today. The CHF is the strongest currency of the day.

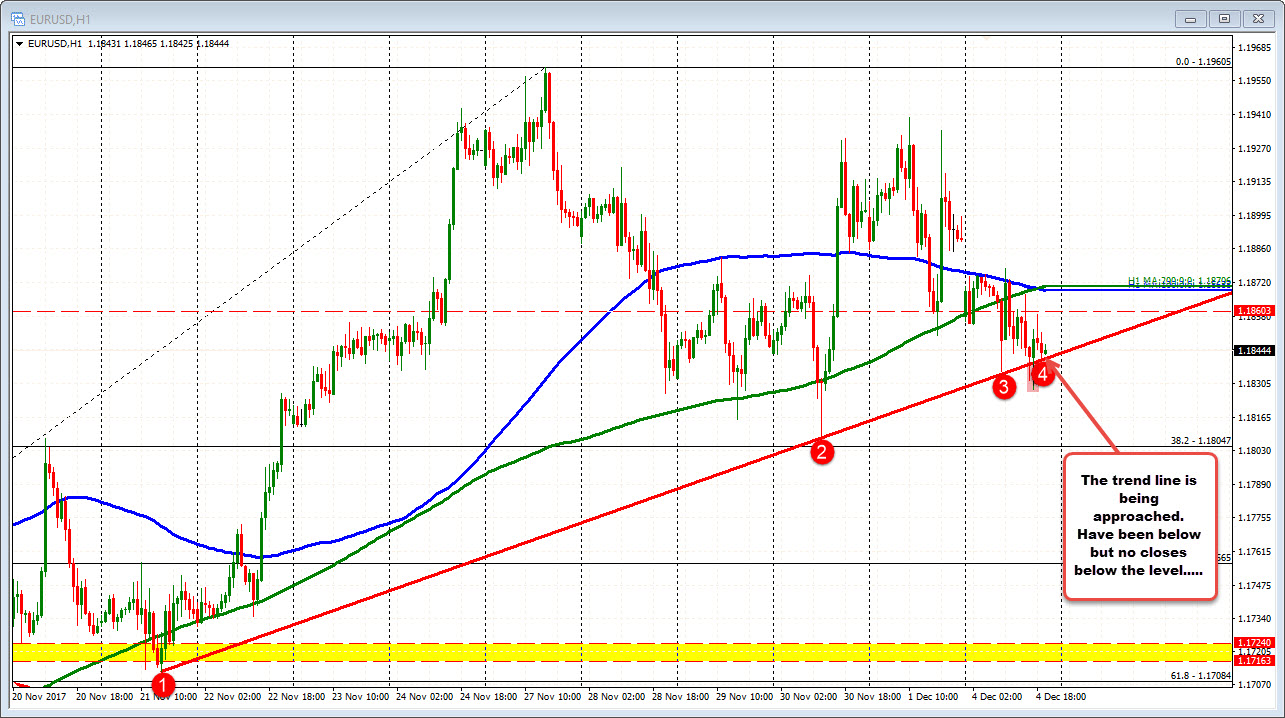

Technically, however, we have just hit a key resistance area. The topside channel trend line is being tested at the 0.9867 level and so far holding on the last two hourly bars. Sellers leaning against the key technical trend line? It seems that way as risk can be defined and limited. If there is a break - and the price stays above - look for the 50% retracement at 0.98855 to be the next major target area.

PS a channel is formed from parallel trend lines on both the top and bottom. On Friday on the market was tumbling lower, the pair approached the lower trend line and started a stall near the level. Yes, the price did dip a few pips below the lower trend line. That can happen in fast moving markets. However, the level did find enough buyers near the level, to stall the fall.

Now we look for the upper boundary to do the same thing.

PSS the last corrective low in the NY session stalled at the 200 hour MA (green line in the chart above). That MA line - along with the 100 hour moving average at 0.98353 - is now support on a dip.