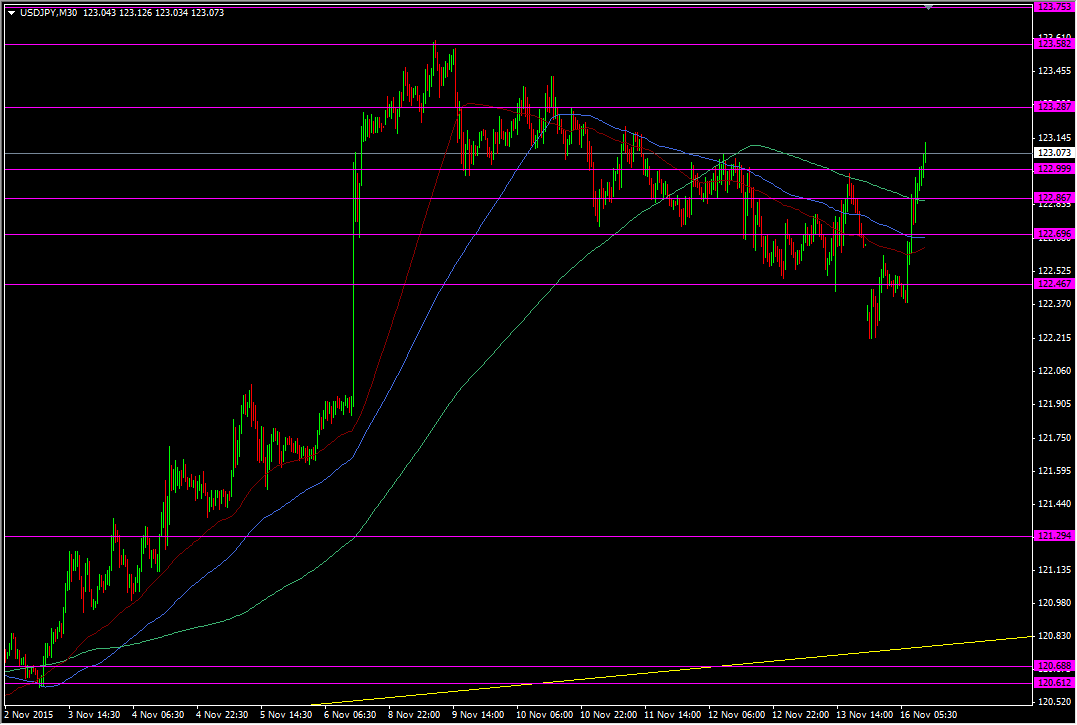

USDJPY makes its way to 123.13 as yen crosses keep on climbing

Japanese GDP was worse than expected. There were some shocking parts, like capex, and some not so shocking parts, like consumer spending. Much of it was expected and with the yen being a safe haven amid the French news, it was no surprise to see it lower today

The yen has given up that role as USDJPY heads into 123.13 and the crosses hit session highs

GBPJPY has surpassed Friday's highs and EURJPY is not far short of its Friday highs

123.30 was a prior S&R level and will likely feature again should the move continue

USDJPY 30m chart

There's two things going on in the yen pairs. Firstly the safety trade is being unwound, and the focus has switched back to what the GDP numbers mean for the BOJ and the possibility of them acting

All the other majors are fairly stable right now which is why it's the yen side of the trade that's driving things. For USDJPY that might be a concern as if it's not general dollar buying, it means that the dollar dippers might not be involved in this move, so it may lack the support to remain elevated. We will get a better idea of that when the yanks touchdown shortly

In the meantime, use a little caution if thinking about buying it up near the top here. At the very least I'd want to see 123.00 hold on a test as that would be a big signal that the rally has legs