The industry chatter ramps up ahead of the 5th June OPEC meeting

In two days we have the 167th OPEC meeting in Vienna and the noise from the members and companies is rising

Here's a run down on what's been said today

OPEC sec Gen El-badri

- There is enough supply and enough demand

- Shale oil is her to stay

- Will meet with Russian oil minister in July

Kuwaiti oil minister

- Prices are good

Saudis Naimi

- Oil price still has a risk premium

- ME political troubles not affecting supply

- Long term energy outlook looks very positive

- May be a "black swan" affecting 2040 energy predictions (Doesn't sound good)

Iran oil minister

- Has no idea what OPEC will decide at meeting

- Unlikely to agree new sec gen this week

- Says they can raise output to pre-sanction levels quickly

- OPEC output ceiling not shared among countries

- OPEC must open way for Iran output to maintain prices

Qatar oil minister

- Oil market should be more balanced in H2

- Number of reasons to be optimistic going forward

- OPEC commitment to market stability is unwavering

- All main players need to work together

UAE oil minister

- Market correction is not over yet

- Optimistic about meeting and seen a very good move on the correction

- Demand is increasing, the correction is there but not over yet and is going to take time

- The glut in the market has decreased significantly

Iraqi oil minister

- Sees prices rising by year end

- Will increase exports by 100kbpd in June after launch of new Basrah heavy blend

- Iraq is now the most important oil producer

- Many companies asking to invest and work in Iraq

- Says there is optimism and general acceptance of current situation (was asked about OPEC consensus on keeping ceiling unchanged)

Angola says it is extremely important that oil price rises to $80 (Someone has their margins in a vice)

That's the bulk of talk at the moment

Overall there's no real indications that we will get any mentions of production cuts. One thing to note will be any comments on the outlook for global growth, and more importantly demand. While not mentioning production cuts will be negative for prices, expectations of rising demand could be positive

Brent prices have been running higher for just under a week now, rising from the low 61's to a top around 65.80. Today's chatter has perhaps knocked back any expectations over changes to production, or rhetoric of such from the members, and we've dropped around 156 ticks to a low of 63.72

The price has been in a minor down trend since the 69.50 highs in April. Oil can be a great technical market when the poo isn't hitting the fan over anything

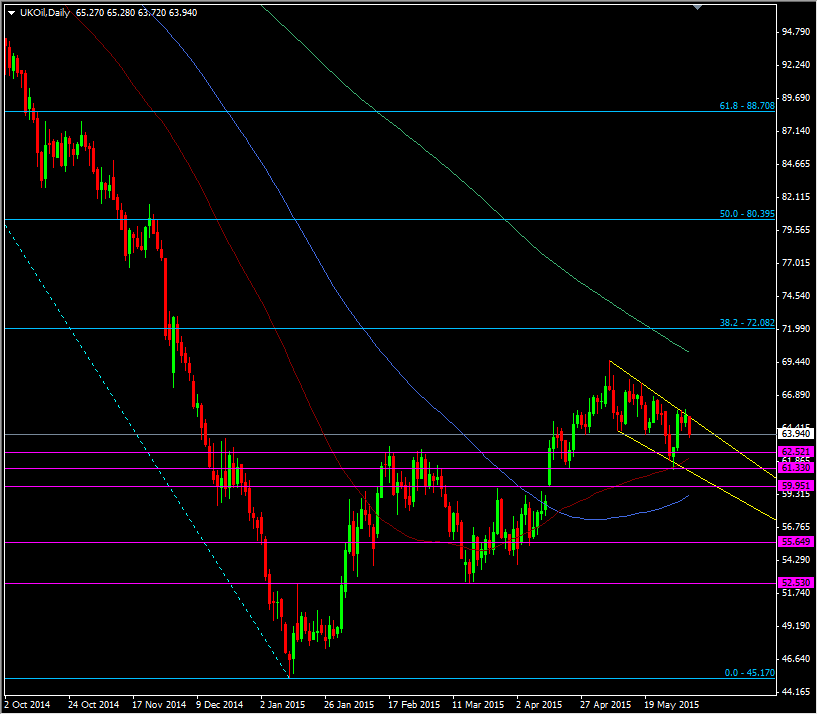

Brent crude daily chart

I've been keeping an eye on the price and hoping that it maintained a bid so I can short it into the meeting. The price may have some US growth premium in it, particularly after the US manufacturing numbers, but the supply and demand picture remains the same. Today's move may have reduced the RR of that trade now but we've still got a day or so to go so the price could recover. If there is any bullish expectation priced into the market then I think shorts are the way to go over the meeting itself.

The first downside level to think about is at 62.50, then 61.33 and there's a pretty strong looking level at 60 and 59.80. A break there could well see a run down to the 55's. Despite any positivity from the US, the global growth picture is still tepid and that is going to keep oil prices from moving too far away from the bottom. I think we have to see big news to get another look at the sub 50 buck lows but I can see scope for the price to maintain a 50-70 dollar range for the foreseeable future