The EUR is the strongest and the JPY is the weakest as the North American session gets underway after the three day holiday. The USD is mixed with modest changes vs. a number of the major currencies. However, the USDJPY is higher and trading at another new high going back to the week of September 28, 1998 after breaking above the high from last week at 135.577. The new all time high is now 136.24.

US stocks are solidly higher as traders come back from the long weekend in a refreshed and better mood.

Bitcoin is higher by $900 or 4.49% near $21,000 after a potential capitulation down to $17,600 over the weekend.

Pres. Biden is mulling having a gasoline the tax holiday. The current price with the only gases near $5 a gallon. According to sources the federal government taxes at 18.3 cents per gallon for gasoline and 24.3% for diesel fuel. States also tax gasoline. So far only a few states have lowered that tax. Although the government may cut the tax doesn't necessarily mean that the other parts of the gas equation lead to lower prices at the pump. Cost me continue to increase. Demand may continue to outstrip supply. Producers may increase profit margins and not pass on the savings to the customer.

Nevertheless the markets are a little bit more buoyant today

Looking at other markets:

- Spot gold is down $3.42 or -0.19% at $1834.87

- spot silver is up $0.07 or 0.34% at $21.66

- WTI crude oil is trading at $110.37

- The price bitcoin is trading at $20,900

In the pre-market for US stocks, the futures are implying a higher open after Friday's mixed results:

- Dow industrial average is up 395 points after Friday's -38.29 point decline

- S&P index up 51 points after Friday's 8.09 point rise

- NASDAQ index is up 158 points after Friday's 152.25 point rise

In the European equity markets the major indices are mostly higher

- German DAX, +42 points or +0.32%

- France's CAC +50 points or +0.84%

- UK's FTSE 100 +37 points or +0.52%

- Spain's Ibex -43 points or -0.52%

- Italy's FTSE MIB +100 points or 0.46%

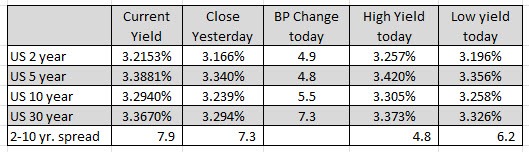

The US debt market, yields are moving higher after the dip last week, but are still off there highest levels by about 20 or so pips:

The high yield in the US reached:

- 2 year 3.454%

- 5 year 3.623%

- 10 year 3.497%

- 30 year 3.493%

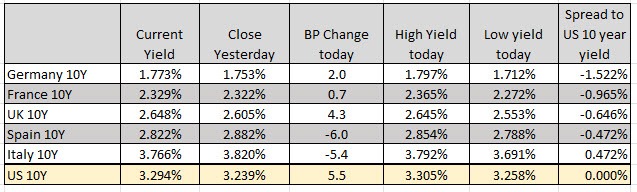

In the European debt market the benchmark 10 year yields are mixed with Spain and Italy moving back down while German yields are higher. The ECB is concerned about the fragmentation between the different countries, the narrowing of the spread between Germany and Italy is what they want: