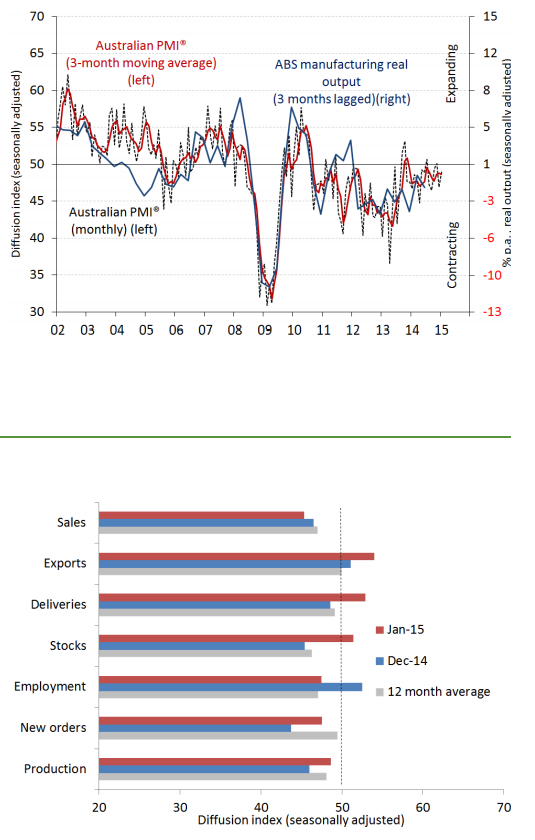

Australia – AIG Performance of Manufacturing index for January: up 2.1 points to 49.0

Australian PMI: Key Findings for January:

- The Australian PMI® increased 2.1 points to 49.0 in January, indicating broadly stable conditions

- Three of the eight manufacturing sub-sectors expanded in January: food, beverages and tobacco (up 2.5 points to 62.9); textiles, clothing & furniture (up 0.7 points to 59.3); and the non-metallic mineral products sub-sector (up 5.9 points to 68.4), which mainly produces building materials and has benefitted from the recent improvement in residential building activity

- The machinery and equipment (down 0.8 points to 42.1); petroleum, coal, chemicals & rubber products (down 2.2 points to 40.7); printing and recorded media (up 5.9 points to 46.1) and metal products (up 2.2 points to 43.1) sub-sectors all continued to contract this month. Wood and paper products contracted for the first time since September 2013, following its 10.5-point drop in December 2014 with a further fall of 6.0 points to 45.1

- Three of the seven activity sub-indexes were above 50 points in December: manufacturing exports (up 3.0 points to 54.0); supplier deliveries (up 4.3 points to 52.9); and stock levels (up 6.0 points to 51.4)

- Manufacturing employment contracted in January (down 5.0 points to 47.5) after a brief expansion last month

- Input costs remain elevated (down 2.9 points to 67.3 points), while selling prices stabilised in January (up 4.6 points to 49.7). The wages sub-index was almost unchanged at 53.5 points

Ai Group Chief Executive, Innes Willox:

- “While manufacturers opened the new year with reductions in sales, production and new orders, the healthy lift in exports is a welcome sign that the fall in the value of the Australian dollar will be a fillip to the sector over coming months.

- In the meantime, however, the depreciation has also been something of a mixed blessing as it has increased prices for imported inputs including capital equipment.

- This adverse impact of the lower dollar, together with the loss of sales from the sharp drop in mining investment, the wind down of auto assembly in Australia and generally weak business investment indicate that the headwinds facing the sector will continue well into 2015″