Preview of the September 2015 ECB governing council monetary policy meeting

Central bankers very rarely pander to what the market's want, unless what they want is what central bankers are going to do anyway

The case in question is more QE.

The market has been like a dog with a stick over trading QE. When you hold the stick ( the dog sits there panting in anticipation "THROWMETHESTICK, THROWMETHESTICK (give us QE), THROWMETHESTICK". When it gets the stick it comes back and drops it and says "TAKETHESTICK, TAKETHESTICK, TAKETHESTICK (end QE)"

This time the market wants a bigger stick in the form of more QE from the ECB. It's not a full on call for more but the players are weighing up what's going on and coming to the conclusion that the ECB need to do more. What are they basing that conclusion on?

What's happening to inflation?

The ECB's mandate is prices. Not only what they are but what the expectations for them are

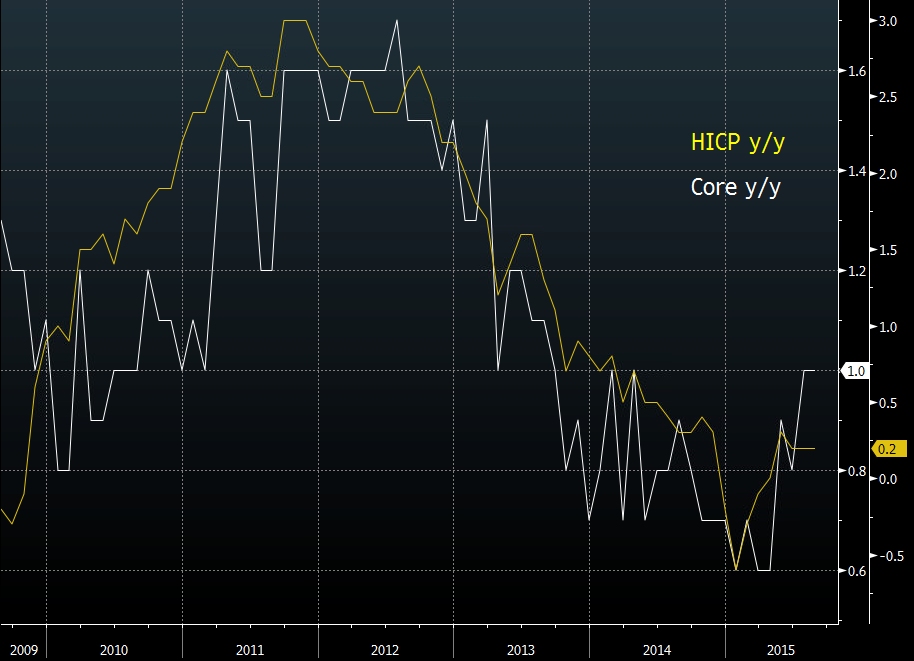

What they are is still soft. The flash August numbers stayed just above zero at 0.2% in the headline and maintained 1.0% in the core.

Eurozone inflation

The core essentially puts them on a positive foot and gives one good reason why extra QE isn't needed. That may not be the view of some of the governing council as Peter Praet suggested last week when he said the council will have to take increased risks to inflation into account

Expectations have also dipped as the latest economic sentiment data showed. Those expectations have fallen from a promising rise in the index to 4.8 in June, to 3.1 in August. Those falling expectations will be a worry to them

What's going on in Europe?

A good indication of that came from the manufacturing numbers yesterday. Weakness around Europe in all but a few and Germany the one tasked with carrying the baton for everyone else

There are still signs that things are changing. Unemployment is falling. Sectors are showing expansion. It's all pretty tepid stuff and certainly there's nothing that suggests the ECB are going to take their foot off the gas

What's happening elsewhere?

We all know what's going on. Global growth is weak and China looks like it will make it weaker. The US is ticking along but looks on a knife edge where it won't take much to tip it. Same for the UK, same for Japan. At least the UK and US have something to give up. Some margin if you want to call it that. It's not a lot though but Europe has even less

Who'd be a central banker?

There's plenty on the plate for the council to discuss and it's here that they might make a pretend move to throw the stick. Draghi is still the right side of the trade on QE. No one expects talk of tapering and he's in the drivers seat to play the tune the market can dance to. If he want's the market to keep the loose policy sentiment and not start tightening on it's own, he only has to utter that the ECB will pump until September at the least. He's already said they could go further but making a point of reminding the market of that fact is as good as giving it the green light. That will keep the euro soft, so as not to affect trade and whatnot, and will (if the textbooks are to be believed) underpin inflation expectations. Job done, monetary policy transmission continues, see you in sunny Malta in October

Of course there's going to be more to it than that. The market will be hungrily going through the latest economic projections that will accompany the announcement. Will inflation forecasts change, will growth estimate change. That's going to be a big driver of markets before Draghi takes questions

Any lowering of inflation expectations is going to lead people to the 'moar QE' conclusion

So Draghi will give the market what it wants with some dovish chatter on QE. The price may not reflect that right now but there's a fair few hours to flow under the bridge until tomorrow

How do we trade it?

I think longs need to be very careful over the meeting. Longs down below might want to think about locking in their profits but perhaps will have the room and the time to assess. Longs in at prices near the market level at the time of the meeting need to be more careful. If forecasts aren't changed, or aren't changed too much, then that might see the euro bounce. The risk then shifts to Draghi's patter

Let me be clear though that I'm not really expecting huge moves. What I am looking for is the euro to perhaps enter a period of weakness for a few sessions. But on the other side, another big market wobble will see it bought up again

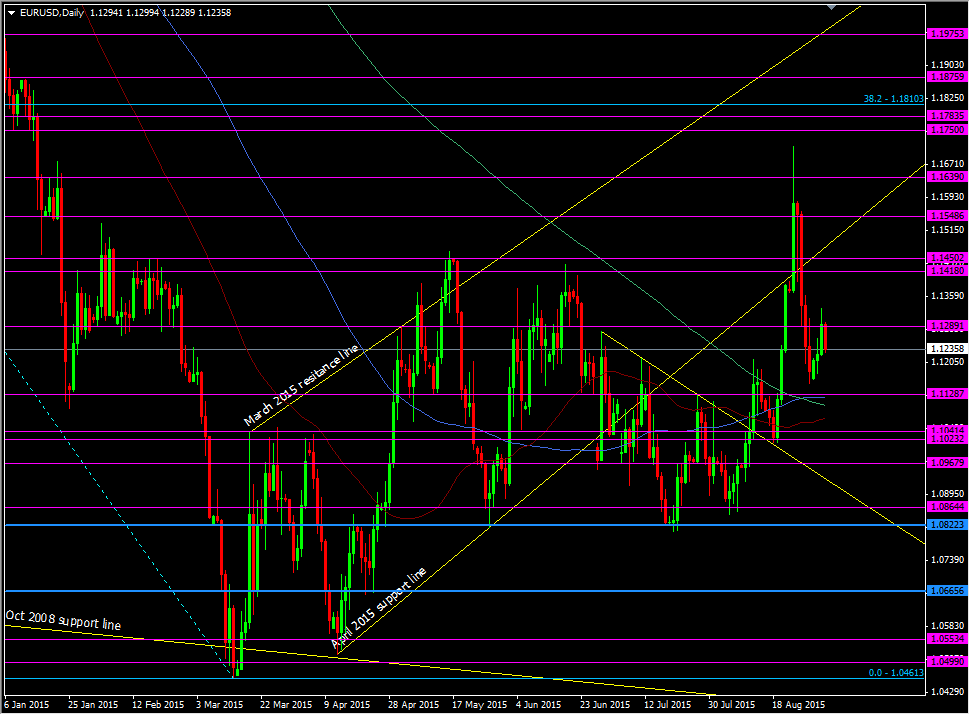

On the charts, and for a short term technical play, we have some interesting levels down around the daily ma's in the low 1.11's and mid-low 1.10's.

EURUSD daily chart

Depending on where the price is tomorrow I might look to have a long play from that area. If the price is too close tomorrow I'll probably leave it alone. If we're around the levels we are now (1.1250-ish) then that tech may be a good stretch point for any Draghi induced moves

On to the central bank merry-go-round we go with Draghi setting the scene before Yellen and the FOMC

Fun and games coming right up

Eamonn has also added his thoughts and noted 5 things to watch in the press conference