Aside from the hike, here's what to watch

1) The Summary of Economic Projections

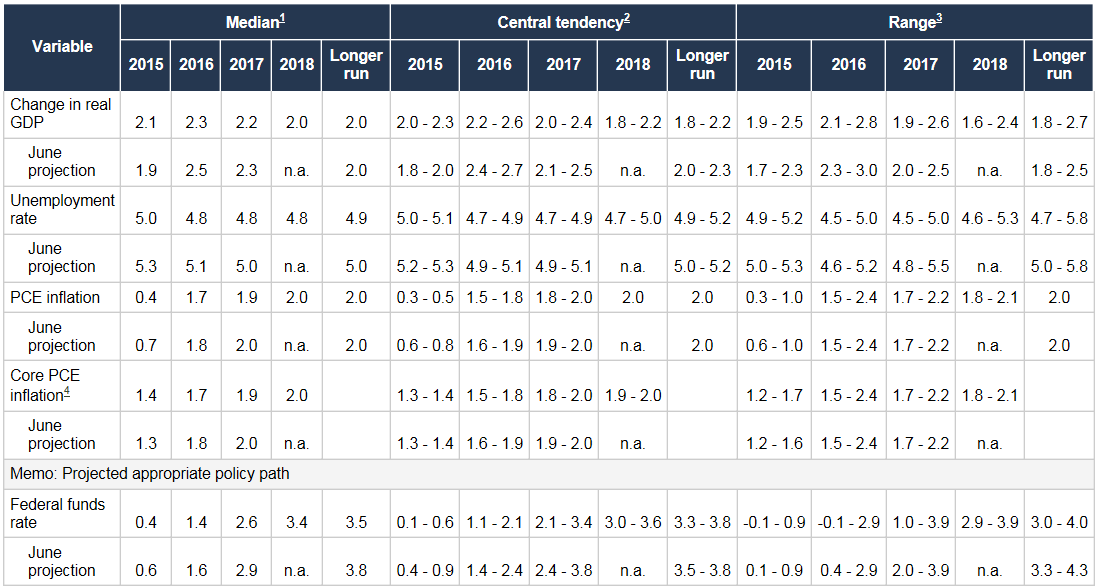

The summary of economic projections currently shows the median forecast for GDP growth at 2.1% this year and 2.3% in 2016. PCE inflation is expected to rise 0.4% and 1.7%, respectively.

2) Guidance on rates

Look for a throwback to the September statement. It was vague about the timeline for further hikes.

"In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation."

In addition, look for an emphasis on graduallyraising rates, which is the 'dovish hike'.

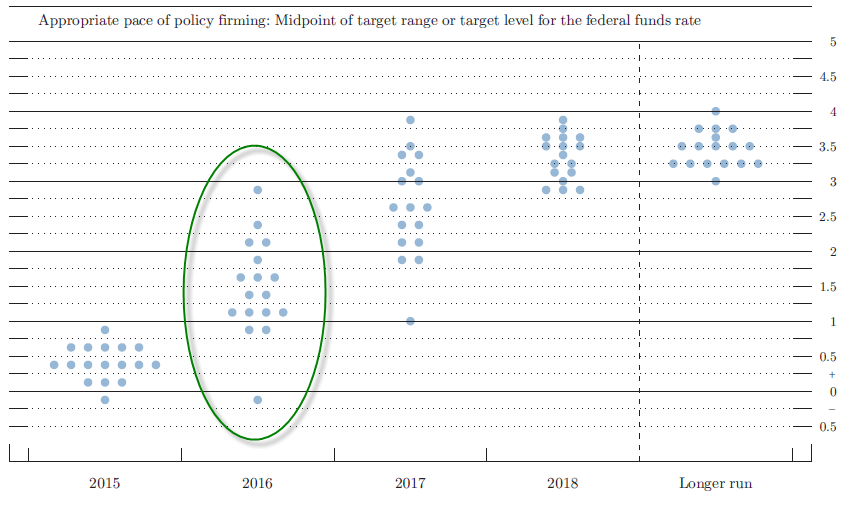

3) The dot plot

I hate the dot plot because it's so vague and it's skewed by some of the ridiculous hawks at the Fed but markets take it as guidance. It always tilts hawkishly and it currently has a central tendancy around 1.50% for the end of next year. That's four more hikes.

4) Technical notes

The Fed is expected to raise the cap on its overnight reverse repo facility to $500B from $3000B and might go with 'unlimited'. The Fed has been testing the program for two years in anticipation and it will be interesting to note any last-minute changes.

I think the big story this week will be if these five rates follow the Fed hike.