Fed predictions on where rates will be are an important signal

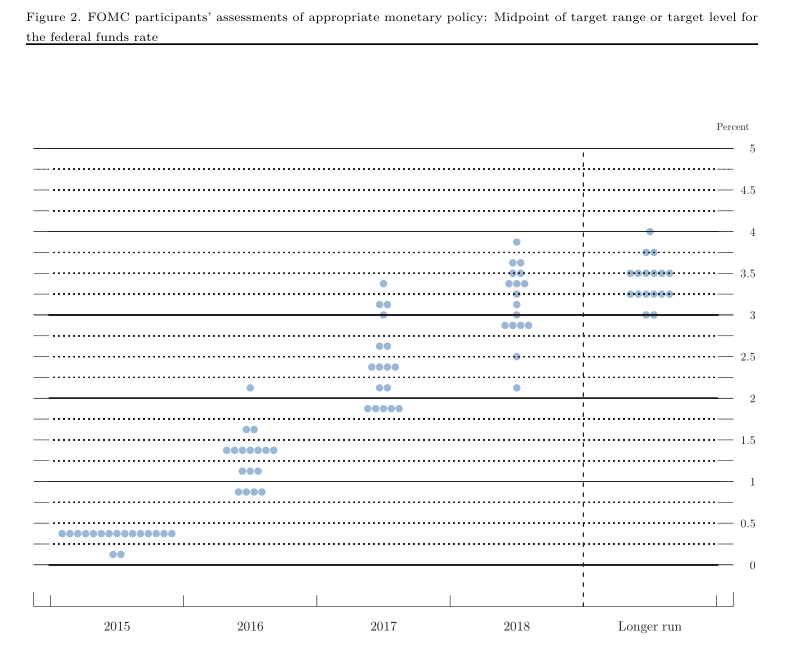

Barring a shock rate hike or extremely hawkish rhetoric, the dot plot is the spot to watch tomorrow. Each dot represent where individual FOMC members believe the Fed funds rate will be at a point in the future.

The main focus is where Fed members see rates at the end of 2016. The current median is 1.375%, which implies four hikes this year. That almost certainly needs to come down, but how much?

The market at the moment is pricing in an 80% chance of at least one hike, a 42% chance of two hikes and about a 13.5% chance of three or more hikes.

The easy way to trade the dot plot would be to compare it to market expectations, but that would be a mistake.

The market knows that the Fed habitually overstates the path of interest rates. In part, it's due to over-optimism about the economy and in part it's because a few FOMC members are relentlessly hawkish. Either way, the market isn't going to believe the Fed.

So what's reasonable? Back in December the Fed was much more inclined to believe in four hikes this year but even then the market priced in just a 10% chance it would happen. The market implied a 31.6% chance of three hikes.

To me, the Fed's ability to convince markets it could still hike three times this year is the battleground in the dot plot. If the media comes down to 0.875%, sell the dollar (all else equal). If it can remain at 1.125% or higher, there's a good case for USD buying.

There is a chance the USD bullishness is trimmed if the longer-run assessment comes down but I doubt it. The market has very little faith in the US ever getting above 2%, let alone the 3.25% current forecast.