Wheeler comments after the release of the financial stability report:

- Declines to comment on NZD value

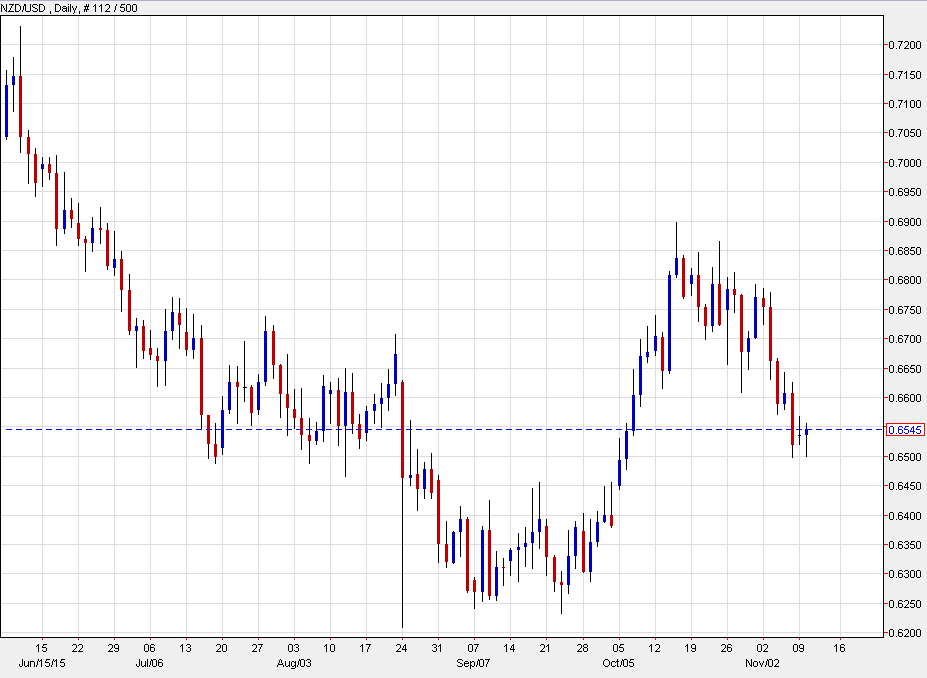

Why does that matter? Because over the past two years he's used every opportunity he's had to jawbone the kiwi lower. Passing on the opportunity is NZD bullish (and NZD has risen 20 pips as a result).

The latest RBNZ statement said:

"The exchange rate has been moving higher since September, which could, if sustained, dampen tradables sector activity and medium-term inflation. This would require a lower interest rate path than would otherwise be the case."

Wheeler could now believe that Fed hikes are coming and he will let that do the talking. It could also mean the next RBNZ statement won't reference the New Zealand dollar.

Or maybe Wheeler is simply trying to manage today's focus

The other argument is that Wheeler has declined to comment on monetary policy altogether in today's appearance and that could be because he wants the headlines in the local press tomorrow to reflect some of the risks/fears he's talking about rather than interest rates or NZD.

He might simply want the headline in the New Zealand Herald to read "Central bank warns on Auckland house prices" rather than "Central bank says strong kiwi could spark rate cut".

If you're trying to keep a lid on house prices (and the RBNZ is), you want to do what you can to promote the first headline.