At the bottom of the hour we have Canadian inflation data for November. On the month it’s expected to fall by 0.2% from +0.1% and to 2.2% vs 2.45 prior y/y. Given the current environment of falling energy prices those drops might be a little conservative but it is November data so there may still be lagging effects not yet in play.

The expectations for the core go against the grain with estimates of a 2.4% gain y/y from 2.3% in October. On the month we’re looking for a drop of 0.1% vs 0.3% prior.

Also out are October retail sales (they’re so far behind the curve this lot) which look to be coming in at an uninspiring -0.2% m/m following a 0.8% jump last time. Ex-autos is looking like 0.2% vs flat in September.

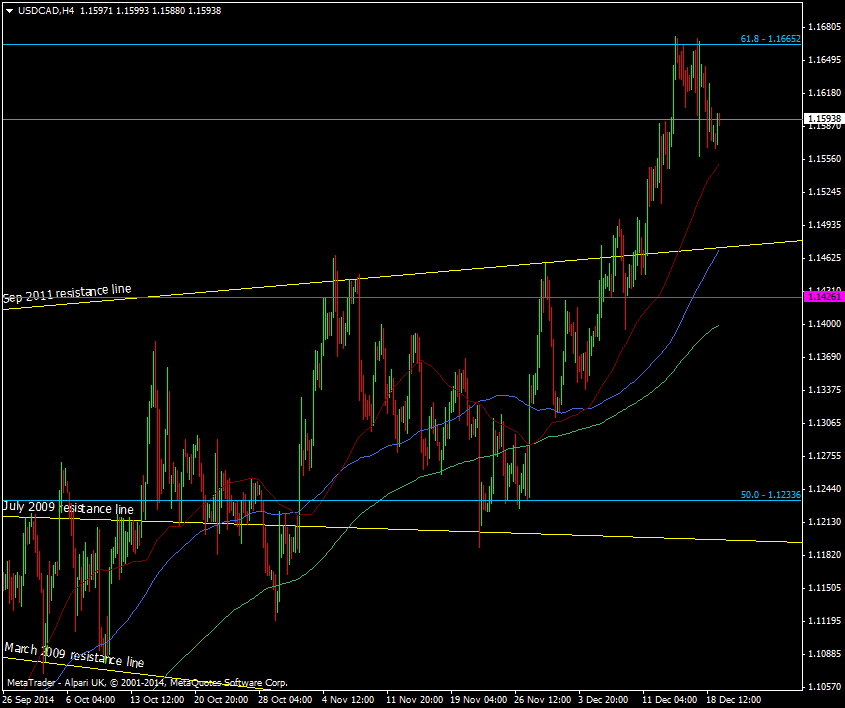

USD/CAD has had several attempts at clearing the 61.8 fib of the 2009 fall at 1.1665 and has dropped back to under 1.16.

USD/CAD H4 chart 19 12 2014

The loonie has settled somewhat after the drive by oil and it remains to be seen whether the market has the interest for another crack at the topside. If inflation does fall more than forecast the market will probably just see that as par for the course given the price risk environment we’re in. If it pops higher again then we could see a half decent downside move if the market has the gumption for it. This is one pair I’m looking at shorting on the inflation picture forcing the BOC into hiking action and possibly ahead of the Fed.