Fed funds might not be telling the whole story

The widely-followed metric on Federal Reserve interest rate hike expectations are Fed fund futures but they might not be telling the whole story.

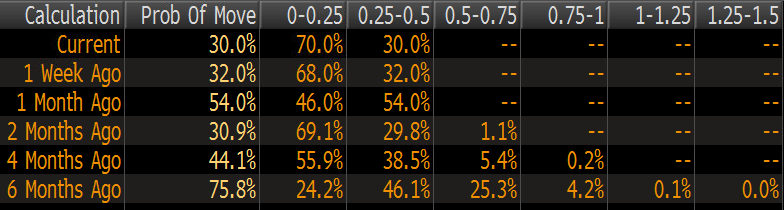

At the moment, they imply about a 30% chance of a hike on Sept 17.

The issue is that other metrics suggest a higher likelihood.

For instance, CRT did a quick survey of investors today (and their readers are generally savvy) and found that 60% expected a Fed hike in September with 13% seeing Oct, 18% December and 10% later.

In Bloomberg's survey of economists, the spit is 26 expecting the Fed to leave rates alone and 44 looking for a hike.

Normally, I'd be the first one to discard the sentiment of economists but something could be afoot here. The skew could be in the Fed's ability to maintain its target.

The rational in the implied probabilities is that the Fed will hit the midpoint of its 0.25-0.50, which is 37.5% but that might not be the case. Because of the $2.5 trillion in excess reserves held at the Fed.

Those are assets held by financial organizations used at the Fed and forced into high-quality assets. The fear is that there is scarcity here. The Fed plans to use Interest on Excess Reserves to boost the overnight rate but not everyone who participates in the Fed funds market has access to those higher rates like domestic branches of foreign banks. They plan to supplement it with term repos but it's all an experiment.

This is a hot topic in many dark corners of the internet and the Fed isn't entirely confident it can keep rates within target, as recent debates in the Minutes show.

What's the trade?

Without knowing the likelihood of a hike, it makes the trade all that much more complicated. If the skeptics are right, then I expect it to actually provide support for the yen because the confusion in the bond market will spark demand for safety. But that could also be the case in the run-up to Sept 17 as market participants get cold feet.