The yuan dropped yesterday on the surprise rate cuts from the People's Bank of China:

At 0115 GMT today we get the latest reference rate setting from the PBOC. FYI, each day the Bank sets a middle point (reference rate) around which USD/CNY is allowed to trade:

- USD/CNY is the onshore yuan

- Its permitted to trade plus or minus 2% from this daily reference rate.

Ahead of the setting here is snippet from ABN Amro on yesterday's data and movements:

The activity data for July .... clearly weaker than consensus expectations.

All in all, drags from virus flare-ups an ongoing strict Covid-19 policies (characterised by ‘mass testing and mini lockdowns under dynamic clearing’) and from property sector woes are constraining China’s rebound from the lockdown slump earlier this year. This is why we had already cut our annual growth forecast for 2022 further last month, to 3.7% (from 4.2%)

PBoC continues with piecemeal monetary easing

Probably reflecting the weaker than expected July data, the People’s Bank of China (PBoC) has cut the 1-year rate on its Medium-Term Lending Facility to 2.75%, from 2.85%. That brings the total reduction of this rate at 20bp so far this year. We think this makes it likely that the 1-Year Loan Prime Rate will be cut further next week. Last week, the PBoC tried to manage expectations by stating that it would not resort to massive stimulus. That said, the latest MLF rate cut is in line with our view of further piecemeal rate cuts to support the economic recovery from the lockdown slump earlier this year.

Lending growth was weak in July, which partly reflects seasonal effects (lending growth always drops in July), but also weak loan demand. This reflects to a large extent the state of the real estate sector, as we have explained before. All in all we expect the PBoC to continue with piecemeal monetary easing, but we also anticipate the authorities will take bolder steps to stabilise the real estate sector in an attempt to mitigate systemic risks and safeguard growth.

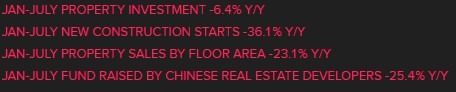

Speaking of the property sector, here is barf-bag data from yesterday (I posted this yesterday, here it again for emphasis):