Just because they like something does not mean you have to believe them

It is easy for retail traders to read that Goldman, Deutsche Bank or Citibank recommends some trade and just blindly do it. But let's face it, how often do they pan out. I often find that they often require too much risk that does not make sense to me.

I tend to give the big boyz the benefit of the doubt that they know what they are talking about fundamentally. What I don't always agree with are their entry and stops. They seem kinda random at times. So I like to critique them myself to see if it is a trade I might consider, but often times adjust the recipe to fit my risk tolerance, and more importantly fit what the technicals are saying. After all, the price and tools to the price give a picture of what "the market" feels. That can change but if it stays the same, the trend can indeed continue.

Adam recently outlined a trade idea from CitiFX. The trade was to go long AUDJPY at 87.72 with a target at 89.85 and stop at 86.40. The reasons for the trade were:

- BOJ easing. Citi expects the BOJ to ease sometimes over the next four meeting and most likely this weeks meeting.

- Yen shorts look attractive while AUD is being supported by more resilient risk appetite and PBOC easing. They cited that baring a very soft CPI, they do not see much risk of RBA easing.

Well, the trade has not gone all that well. The price of the pair has not benefited from the story. There were headlines that Japanese officials don't see a need for further BOJ easing. That weaker JPY undermine consumer purchasing power. Meanwhile over in AUD land, the stock markets have been pressured. On a quiet day in the US the slow move lower in stocks, and concerns about earnings/Fed can exaggerate the move (or at least not provide a reason to go against the directional move).

As a result, the story given for the trade has not panned out. The price of the AUDJPY is down, and the stop at 86.40 is in jeopardy of being triggered (the low today is 86.60 so far).

Was the trade a good idea?

Well, the fundamental reasons cited by Citi seemed plausible. Stock were more supported last week, helped by Amazon, Microsoft and Google (risk on). Trade data from Japan was not great so fundamentally, and that would beg for more BOJ stimulus and a lower JPY (higher AUDJPY).

But the problem I have is the reasons cited were fundamental stories. Fundamental stories don't define risk or a bias. They just tell what a person or persons THINK. I THINK a lot of things fundamentally about what may happen, but my educated thoughts on what may happen, cannot move the price one single pip. "The Market" has to agree with me and apparently. The "Market" had to agree with CitiFX as well.

When I have a fundamental story to tell, I like to back it up with a technical story that will become the real reason(s) for the trade. Why? Because the technical story defines and limits risk in case my fundamental story is WRONG.

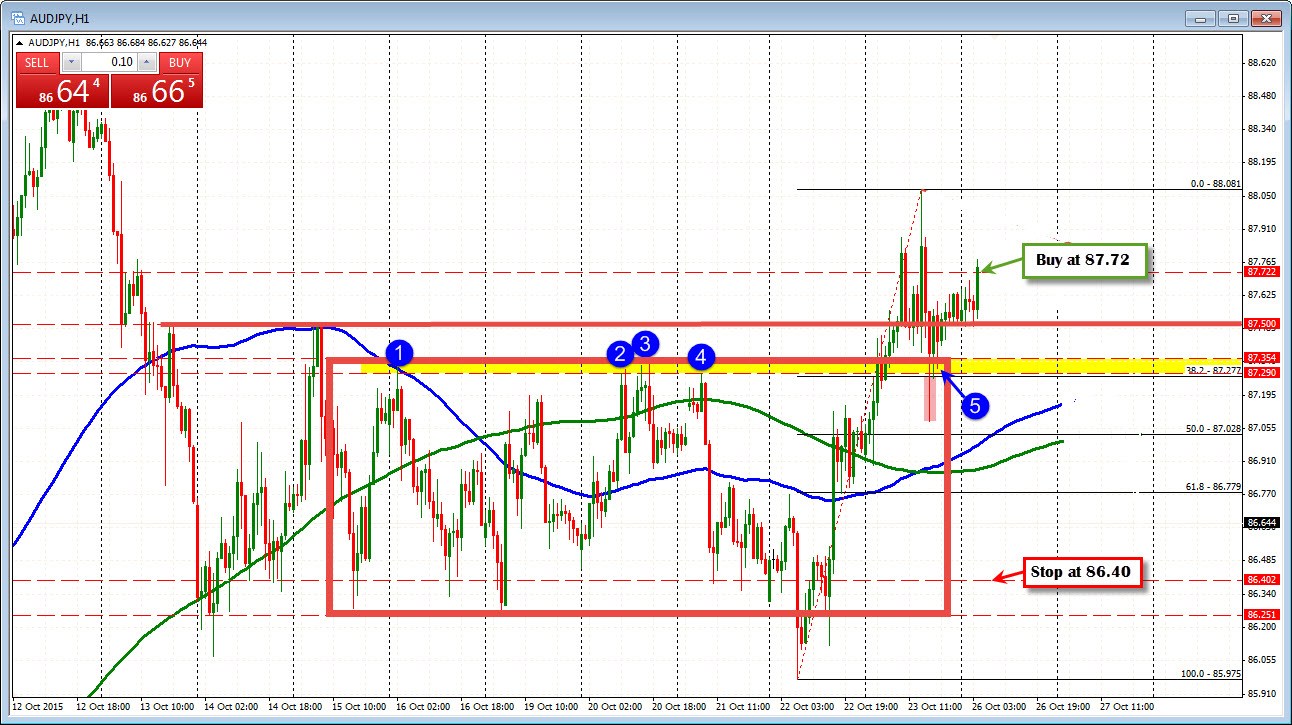

Looking at the hourly chart of the AUDJPY above (I have erased the stuff after the trade entry to get a clear picture of their thinking), I can see why they liked buying. The price had moved outside a box (the RED BOX) that confined the pair in an up and down environment from Oct 15 to Oct 23rd. That is bullish. There was a single bar that reentered the "box" on Oct 23, but that was during a volatile period and was quickly reversed.

So the buyers look to be taking control from that perspective. In addition, the price moved above the 87.50 level which was the highs going back to Oct 13 and Oct 15. Late on Oct 23 and early on Oct 26, that level held support too (see red horizontal line). So the bulls are showing control technically. The next targets become the highs from Oct 23 and if they can be breached, the upside definitely has room to roam. So I can see the trade from a technical perspective, and their hope as well (i.e. the upside targets).

But what about the risk?

Here is where Citi's view starts to differ from my thinking. If the trade reason is to buy because of the fundamental reasons, when do you get out? When the fundamental reasons change or 86.40 whichever comes first (they never say why 86.40 is the stop).

From my trading perspective, if the trade reason(s) are fundamental AND technical, a move back below the bullish technical reasons, starts to discredit the bullish technical bias. So a move below 87.50 and then into the "red box" would be a concern to me. It would suggest a turn from bullish to more bearish - technically.

Yes the fundamental story may still alive, but the price action from "the market" is not in agreement. I have learned to not fight "the market" price action as I rarely win.

Now traders may want to risk more than the top of the the "red box" to stay in the trade because of their fundamental bias. That is ok, but if the fundamentals are so bullish (in this instance) shouldn't "the market" also see the obvious? I would think so.

But for me there still has to be a limit. After all, no trader - professional or retail - is perfect and "the market" can take it's pound of flesh.

So in this example, a more conservative stop, could be the rising 100 and 200 hour MAs (blue and green lines) or the 50% of the move up at the 87.028 level. If the price were to go below each of those three technical levels, would it not change the technical picture markedly from bullish, to one that is more bearish? I think so. I would think that fundamentally, the story might also be changing too by that point.

So overall, I am not critical of the trade from a bullish technical and fundamental perspective at the time of the trade. I just think the risk was too much. There were closer risk levels that could have been defined and made the trade more attractive from a risk stand point. Moreover, because risk could have been limited the reward target may not have had to been so high.

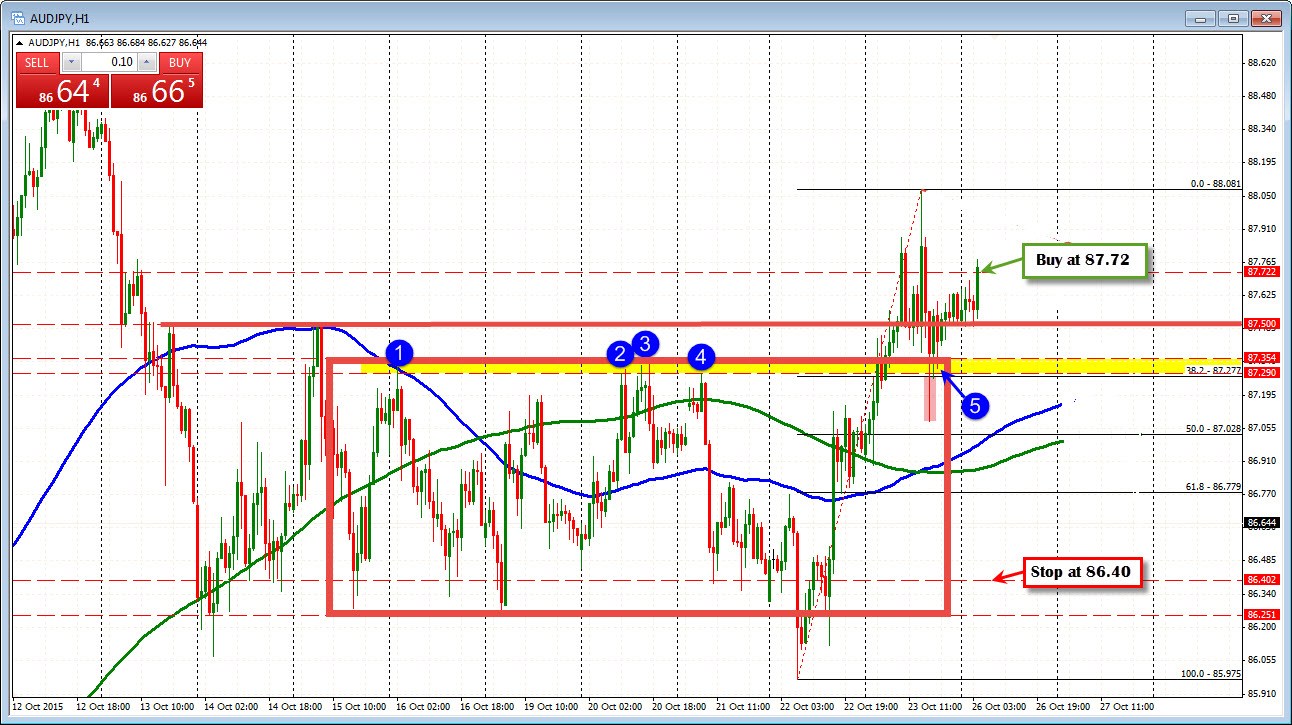

So what does the picture look like now?

Not so great (see chart below). The stop is still alive but it is getting very close. Moreover because, the pair has moved below what was once support at the 87.50, the top of the red box, the 100 hour MA, the 200 hour MA and the 50% retracement, the going will be tough to get back above them even if the stop is not triggered. There should be a fight from the sellers who may line up against those levels.

In addition, traders who are long from above, are likely feeling less confident about ever reaching the 89.85 target. They might now be happy to get back to breakeven (or even to where the real stop should have been). So in effect, because risk was so great, the risk/reward profile was really quite fake. That catches up to traders over time. In theory, traders who are still in, should wait for 89.85. Few will. It is 315 pips away now....

If the trade was executed but stopped out even at 87.02, the trader has booked a loss, but the overall risk was less. The trader also has the ability to get back in at a better support level or even when the price moves back above the levels broken (even the 87.02 exit level). The advantage is the trader has a clean slate, a fear-free mind, and that is always better than a mind full of fear.

It is easy to fall for the idea that the big names and trades they take must be good, well thought out trades. However, if you were to critique them by looking at their fundamental reasons and then fit in your technical risk defining levels you might find that what they propose really does not make sense.

This trade had good intentions fundamentally, the profit target may have been doable, but the risk level? It just does not make sense from a technical perspective.

Update: Citi suggested buying at 87.72 with a target at 89.85 and a stop at 86.40. The pair fell to a low of 85.43 before rallying to 90.00.