Learning to use the SMA+ADX trading strategy

In this article, you will get acquainted with a simple strategy meant for trading in Forex or corresponding currency futures markets. According to the author, the best instruments for the strategy are GBP/USD, EUR/USD, and USD/JPY. As for futures, they would be 6B, 6E, and 6J. The timeframe is strictly H4.

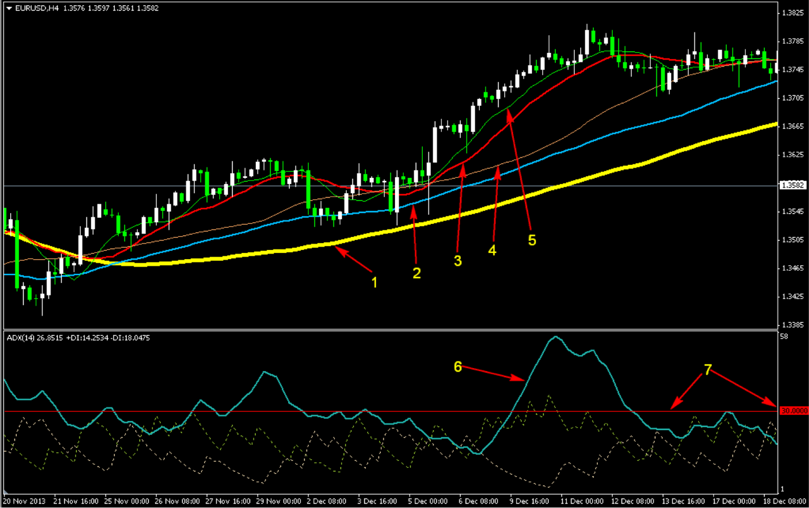

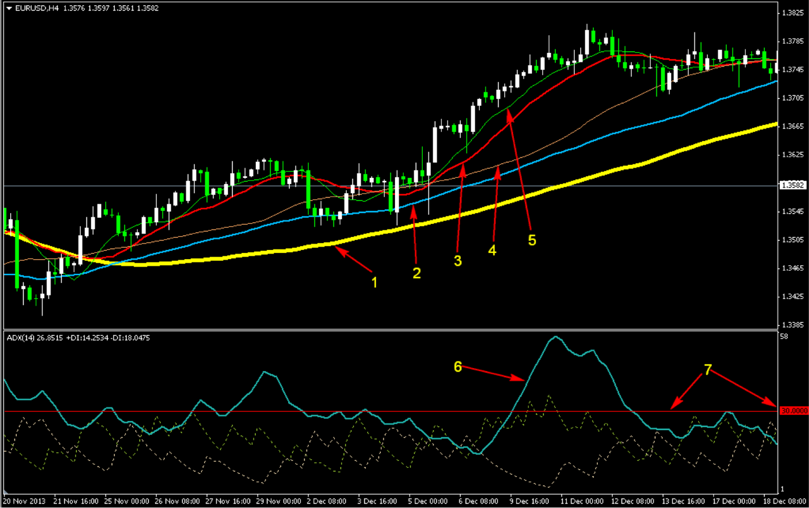

SMA+ADX desktop

Explications

1 - Moving Average(100), method: Simple, apply to: Close

2 - Moving Average(60), method: Simple, apply to: Close

3 - Moving Average(16), method: Simple, apply to: Close

4 - Moving Average(40), method: Simple, apply to: Close

5 - Moving Average(10), method: Simple, apply to: Close

6 - ADX main line with standard parameters

7 - level 30 of the ADX

👉 If you want to learn more about how to use Moving Average indicator or how to trade with ADX indicator, please see the corresponding articles.

A signal to buy by SMA+ADX

The SMA(16) crosses the SMA(60) from below. The close price, at the same time, must be above the SMA(100), and the main line of the ADX must be growing during the two latest candlesticks. This means it must be below 30 two candlesticks ago.

An example of a signal to buy

A signal to sell by SMA+ADX

The SMA(16) crosses the SMA(60) from above. The close price must be below the SMA(100), and the main line of the ADX must be growing during the two latest candlesticks. This means it must be below 30 two candlesticks ago.

An example of a signal to sell

When all the conditions are fulfilled, enter by a normal market order. The money management method is up to you. Whichever the method, do not risk in more than one position simultaneously, i.e. if you have one position open, do not enter a second one, unless your first position is not transferred to the breakeven or closed.

Stop Loss and Take Profit by the strategy

Place the initial Stop Loss behind the last local low when you buy and the last local high when you sell. Transfer the SL to the breakeven after the price gains several ticks: 70 ticks in your direction (or 700 ticks if you trade five-digits) for GBP/USD and EUR/USD, 50 ticks (500 ticks if you trade three-digits) for USD/JPY.

No Take Profit is needed in this strategy because positions are closed after the SMA(40) and SMA (10) crisscrossed: if your position is long, the SMA(10) must cross the SMA(40) from above; if you are playing short, the SMA(10) must cross the SMA(40) from below. Even if you have not transferred the position to the breakeven but the SMA(40) and SMA(10) have already crossed, exit the market.

Mind that placing the SL behind the local extremes is my own invention because I never trade without an SL. Meanwhile, the author of the strategy advises against the initial SL and suggests waiting for either the conditions for transferring the position to the breakeven or a signal for closing the position. Which approach to choose is up to you.

An example of trading

As long as the timeframe is H4, this strategy suits those who spend most of their time doing other activities. Thanks to being simple and formalized, it is good even for beginners. And as long as all the parameters are measurable, you can even create a trading robot based on this strategy.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex