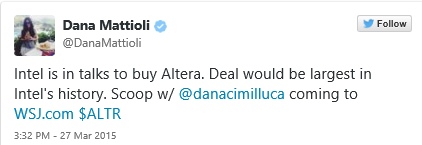

A computer program likely made a trade that netted $2.4 million.

Fortune reports on how one tweet earned a trader $2.4 million on a $110,000 trade.

There's a cottage industry in markets dedicated to machine-reading tweets and alerting traders. I suspect they run on grey box programs rather than black boxes but they alert traders to potentially market moving news and they're good. M&A is especially fruitful because it's serious fast money.

At about 3:33 p.m. ET on Friday (the tweet was out at 3:32 pm), someone bought options contracts worth about 300,000 shares of Altera with a strike price of $36 and a mid-April expiration for $0.35. Seven minutes later, shares were trading at $44.50 and the options were worth $8.50 each.

The Fortune story questions whether someone would be fast enough to make the trade in a minute but I think that's plenty of time if you're alerted to the tweet. If you're not following @forexlive, you should be. It's one of the fastest sources of breaking news and we quickly circulate rumors and breaking news from elsewhere.

I think, however, that there may come a time when fully black box operations can make the trades. It's probably a matter of refining the language parameters and then having some safeguard that measures the market move against what input goes into the system. That will be a watershed.

For the moment, I believe the best way to trade is to leverage as much technology as you can into decision making. I've heard of plenty of traders who regret trades but I've never heard of one who regretted in investing in another computer screen.