The Reserve Bank of Australia March 2019 monetary policy announcement is due at 0330 GMT today.

Expectations are near unanimous on an 'on hold' decision. I mustn't grumble but have said before I reckon the Bank is wee bit complacent. They've been missing CPI target for years and their forecasts for getting back into the target band have been wrong for years also. Can't be too harsh, we all make mistakes on forecasts, but I do take issue with the overconfidence displayed to keep making mistakes and not addressing them. Its time to own the mistake, admit it, correct it, and move on.

Anyway … mustn't grumble.

Earlier previews here:

- Reserve Bank of Australia meet on March 5 - preview

- Big two days coming up from the RBA - meeting then Gov Lowe speech - preview

This now via TD:

- Governor Lowe noted "As was the case six months ago, it does not see a strong case for a near-term change in the cash rate."

- "The RBA can take comfort that businesses are holding up better than NAB's Dec Survey suggested (Q4 capex/Jan employment were strong), helping to provide a cushion against the soft consumer."

- "The RBA will not be privy to Wed's Q4 GDP outcome. Although the risks to the RBA's implied 0.6%/q forecast is to the downside, a cut by April or May appears unlikely given the medium term emphasis. We pay May OIS at 1.4525%, target 1.50%, stop 1.42%, A$50k/bp."

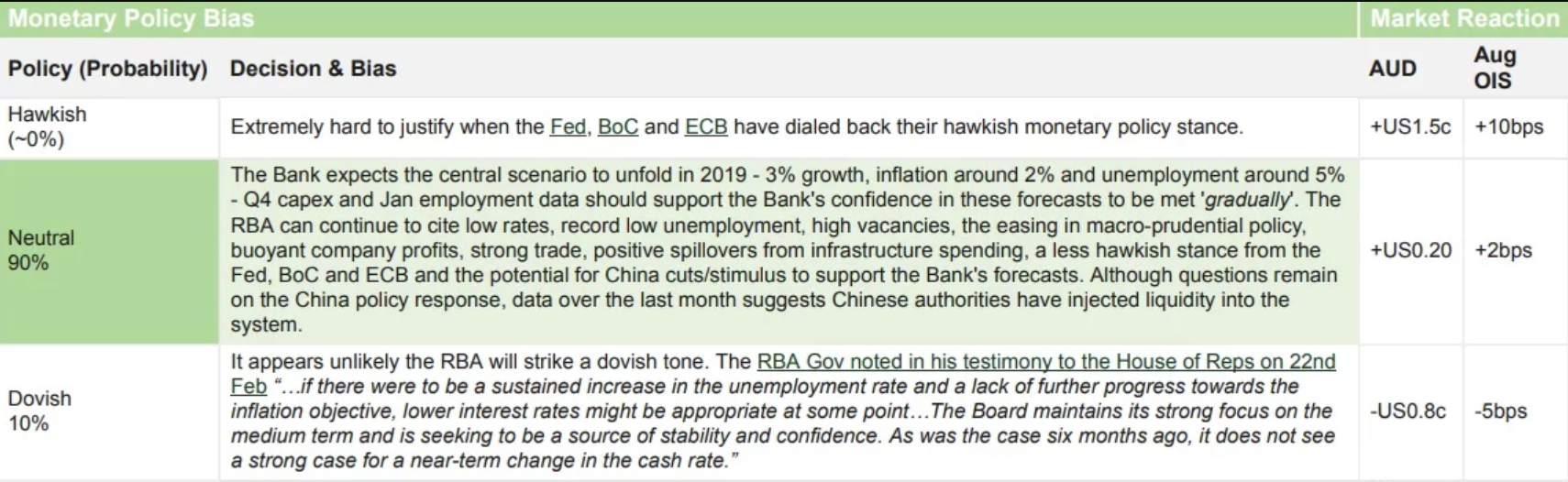

And, more, TD on the AUD response under various scenarios: