Various comments on the Turkish lira and the crisis growing in Turkey

These via the Financial Times, link here for much more, may be gated Turkey promises plan to calm markets and halt lira's fall

In brief:

Rabobank

- continued slide in lira

- coupled with shrinking confidence among Turkish households and corporates

could see a run on the country's banks in the coming days

without a synchronised effort from Turkey it would be "difficult to expect a respite for the battered lira and local assets"

Bolding mine, you can expect to see more of this 'run' talk

Joachim Fels, global economic adviser at Pimco, puts the Turkish moves in context:

- "This looks like yet another example of how a combination of bad domestic economic policies turning worse and deteriorating global liquidity that makes bloated dollar-funded balance sheets vulnerable can produce high volatility and contagion"

As a ps, you will have read in past months this point (EM vulnerability to DM central bank winding back stimulus) made again and again. DM currencies (USD, EUR … and the others) have been heavily borrowed, by EMs amongst others. If you are an EM, or a firm in an EM, and you've borrowed in an offshore currency, and if your local currency is falling against against the currency you have borrowed in your repayments are getting larger than perhaps you might have budgeted for.

Also as a ps. Fels comment is a quickie, but he makes the key point:

- a combination of bad domestic economic policies turning worse and deteriorating global liquidity

Bolding mine … just in case you are taking away this all about USD issues - its not. Fels is not a dummy.

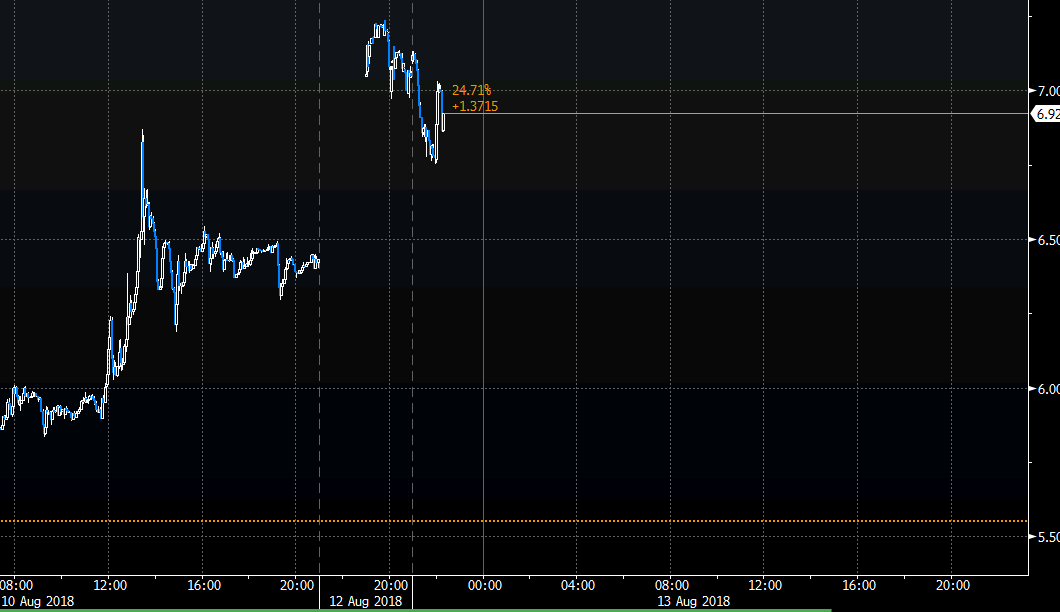

Update to TRY: