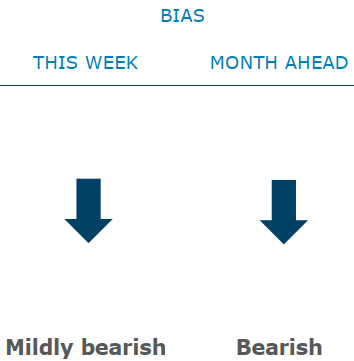

ANZ's weekly forex strategy note, just pulling out a snippet or two, bolding mine:

Key themes:

- The AUD, the NZD and emerging market (EM) FX all remain at the mercy of shifts in sentiment. And things don't look pretty on that front. Each of the recent triggers (Turkey, weaker CNY, higher US rates, EM turmoil and geopolitics) are not big enough to drive sustained losses in markets, but cumulatively, they are generating a toxic environment for risky assets. Until the Fed shifts its relentless tightening bias, demand for the US dollar and troubles for EM look unlikely to abate.

On AUD/USD:

The AUD lacks a catalyst for a sustained move higher.

- The domestic data flow is uninspiring from an RBA rate hike perspective, even more so after the disappointing Q2 CPI.

- The global environment will continue to dominate moves.

- With a number of positive events, like China's stimulus failing to boost the AUD materially, the environment is increasingly challenging.

- Risks around the housing market are also weighing on the Aussie