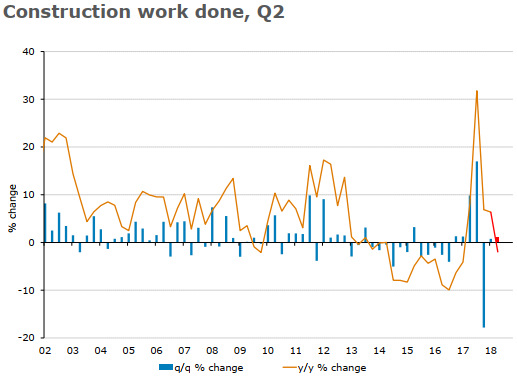

Due at 0130GMT on Wednesday 22 August 2018

- expected +0.8% q/q, prior +0.2%

The data will be an input into GDP for Q2

ANZ preview:

- We believe construction nudged higher again in Q2. The public sector is likely to be a key component of this result, driven by a large backlog of work across the engineering (road and rail projects) and non-residential building segments. Privately funded work is likely to be more subdued, with conflicting drivers between a still-strong pipeline of housing construction, weighed down by the remaining decline in mining-related engineering projects

Via NAB:

NAB broadly expects a modest rise, there are a few key underlying trends to consider

- First is the softening in residential construction activity, alongside the cooling in the housing market. Housing prices are now declining in both Sydney and Melbourne, and residential construction is slowing alongside it. NAB expects a moderate 1.4% q/q decline in residential work done

- Offsetting the slowdown in residential property activity is the large and growing commercial property and infrastructure work pipeline. Tight commercial property markets, particularly in offices and warehousing have created a pipeline of building work, despite a recent softening in approvals

- Further, a number of Federal and State government projects over the next few years are expected to support construction work for some time.

For this quarter, NAB expects increases in construction work for non-residential buildings and public engineering work, of 1.5% and 3%, respectively. Taken together with a solid growth of 1.5% in private engineering construction, we see total Work Done increasing 0.8% in Q2.