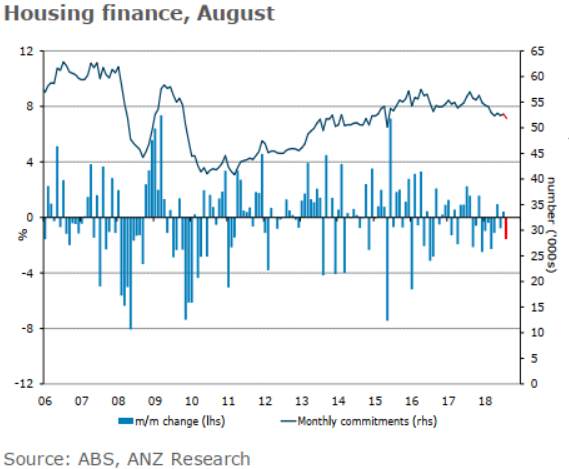

Coming up at 0030GMT, the home loans data from Australia for August

Home loans m/m

- expected -1.0%, prior was +0.4%

Investment lending m/m

- prior was -1.3%

Owner-occupied loan value m/m

- prior was +1.3%

Preview via ANZ:

- We think the number of owner-occupier housing finance commitments fell moderately in August If realised, this would see monthly approvals fall to the lowest level since 2015. Within the release we will also be watching the value of investor borrowing, which has been falling even more substantially than the owner occupier segment. Ongoing credit tightening means this is likely to continue.

Via Westpac:

- The August update is likely to be a weak one. Housing markets continued to correct in the month, albeit with auction clearance rates showing some signs of finding a base. Overall we expect owner occupier finance approvals to be down 1.5%. The value of investor loans will again be of interest, as will the average value of owner occupier loans given the tightening in lending standards that looks to be behind the latest softening in conditions and prices.