I posted a preview of the Australian jobs report here earlier

And, this:

Due at 0130 GMT Australia Labour Market report for April

- Employment Change: expected +20.0K, prior +4.9K

- Unemployment Rate: expected 5.5%, prior 5.5%

- Full Time Employment Change: prior was -19.9K

- Part Time Employment Change: prior was +24.8K

- Participation Rate: expected 65.5%, prior was 65.5%

Another preview now, this detailed work via Westpac begins with a look at the previous result:

- Australian employment grew just 4.9k in March but just as significant, the 17.5k gain in February was revised to -6.3k.

- The ABS now tells us that February was the first negative print in a record breaking run of 16 consecutive monthly gains. This was a bit of an anti-climax for what should have been a quite momentous occasion.

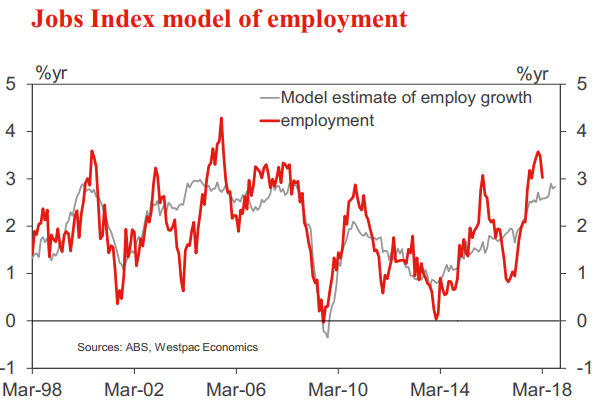

- A run of weak numbers were to be expected. After all the upswing in employment through the second half of 2017 was well above what our broader leading indicators were suggesting. The three month average gain has fallen from 45.7k in January to 12.0k in March while the annual pace of growth has eased back to 3.0% from 3.6% in January.

And, for April (today's report):

- Our analysis of the various business surveys suggests employment growth of something closer to 2¾%yr. Our 17k forecast for April will see the annual rate ease back to 2.8%.

More detailed on unemployment:

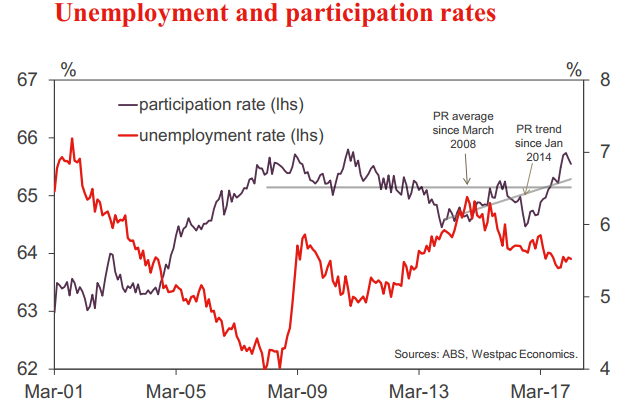

- Despite weak employment the unemployment rate was flat at 5.5%, which had been revised down from 5.6%. The participation rate was 65.5% down from February's figure of 65.6%.

- It appears that the unemployment rate has at least flattened so far in 2018, or can even be described as rising a little with a March quarter average of 5.52% vs. 5.45% in the December quarter. We also noted that the participation rate has drifted down a little but it is not far off the recent record high.

- We estimate the participation rate will round up from 65.5% in March to 65.6% in April resulting in a 17k lift in the labour force. As this matches our 17k forecast gain in total employment, the unemployment rate holds flat at 5.5.

- We should note given just how high the participation rate is, it is possible we will see a lower unemployment rate due to a further fall in participation.

---

Yesterday we got the first quartier wages report - still disappointing with little growth in real wages at all.

- A quick take on the Australian wage data: remains very weak ... real wages barely rising

- Australia Q1 Wage Price Index: 0.5% q/q (vs. expected +0.6%)

Slow wages and high debt loads are weighing on consumer spending and on the economy more broadly.