National Australia Bank Business Survey for October

Yeah, an improvement for both. Still terrible figures.

NAB's key points, in summary:

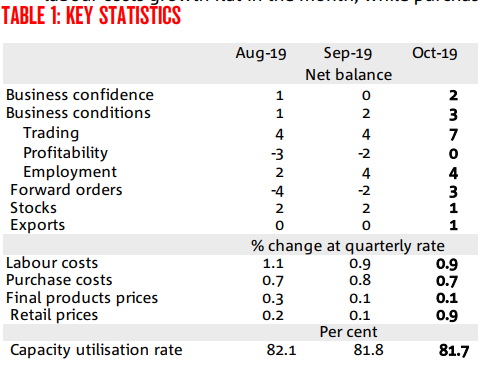

- results continue to point to only modest outcomes in the business sector

- forward-looking indicators have improved slightly and may be pointing to a stabilisation in conditions

- Conditions and confidence … both remain below average

- The improvement in conditions was driven by an uptick in trading and profitability with the employment index flat.

- Ongoing reads of below-average trading conditions and profitability, will likely put at risk the continued strength in the employment component.

- In trend terms, the strength in mining appears to have faded over recent months, and the services sectors now see the best conditions. Retail and wholesale remain weakest.

- Inflationary pressure remains weak, with final products prices still growing at a low rate - notwithstanding a pick-up in retail price growth in the month and input price growth tracking at a higher pace.

- Overall, our read is that the survey continues to point to weak outcomes in the private sector, and that business' own outlook is for more of the same. Acknowledging that the impact of recent rate cuts will take time to flow through the economy, it appears that the support provided by both fiscal and monetary policy this year has done little to offset the slowdown in the business sector.

--

Background: