Announcement due at 0130GMT, Retail Sales for July

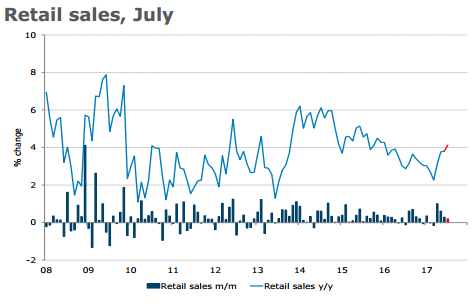

- expected 0.2% m/m, prior 0.3%

Greg posted earlier: Forex technical analysis: AUDUSD will need to weather it's own storm of data

More previews ...

Via ANZ:

- We expect monthly retail sales growth to have moderated in July following a strong Q2.

- Our pick is for a 0.2% m/m rise, well down from the 0.6% m/m average for the past three months. Nonetheless, a result in line with our expectation would see annual sales growth lift to 4.1% y/y, reflecting the weakness in sales a year ago.

- While consumer confidence lifted and petrol prices fell in July, house price growth is slowing and household budgets are facing several challenges (including higher energy bills as of 1 July).

---

And, via Westpac:

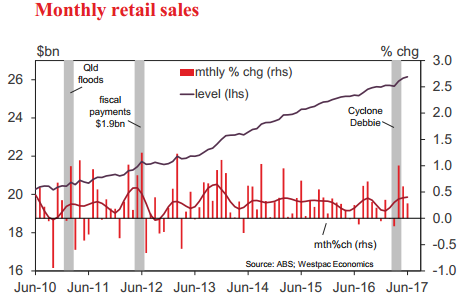

- Recent months have seen retail sales recover from weather disruptions at the start of the year, with a 1% rise in April followed by a 0.6% gain in May and a 0.3% gain in June.

- Recall that the start of 2017 saw an abnormally high number of heatwave and wet weather days across the eastern capital cities with severe weather from Cyclone Debbie also impacting in late March

- The rebound in momentum is now fading. Meanwhile the backdrop in terms of consumer sentiment remains shaky with signs family finances came under renewed pressure through mid 2017 with mortgage rate increases and continued concerns around housing markets more than offsetting an improvement in labour markets. Aggressive price discounting remains a factor as well. On balance, we expect July to post a weak 0.2% gain for monthly sales.

-

For the AUD, with expectations low a beat should be a positive input.