Forex trading preview for the July 15, 2015 Bank of Canada decision

The only guarantee at the BOC decision is that Poloz will talk with his hands

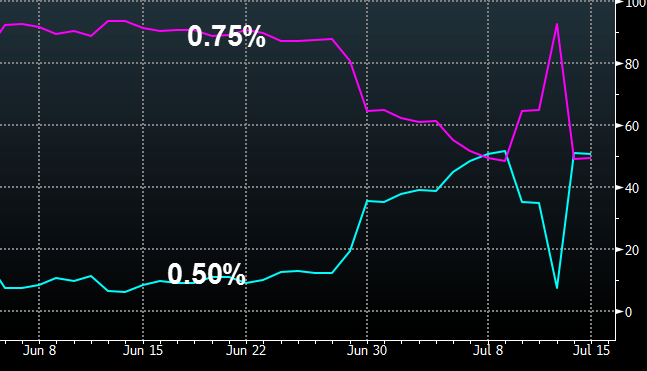

The market has been wildly uncertain about what the Bank of Canada will do on Wednesday at 10 am ET (1400 GMT).

The OIS market is currently pricing a nearly perfect 50/50 probability of a BOC cut. Yet only one day earlier, it was pricing only a 7.3% chance of a cut and 92.7% chance rates would be left alone. The fluctuations since late June have been dramatic.

OIS implied probabilities

The obvious response is that Canadian OIS isn't the most efficient and liquid market but if you look closer at how those probabilities shift, it's still somewhat instructive. When probabilities of a cut on Wednesday fell, they rose in for the September meeting.

The simple way of looking at it is that the market generally thinks there will be a cut Wednesday or strong hints of a cut at the subsequent meeting.

This month, the implied probability that rates will be lowered Wednesday or in September has consistently been in the 53-70% range.

What are economists saying?

First of all, there isn't a great reason to listen to Canadian economists. None of them forecast the rate cut in January and in the weeks after that move, most of them forecast another cut in the subsequent months that never materialized.

But for what it's worth, 29 economists were surveyed by Bloomberg. Fifteen see a cut and 14 see no move. It doesn't get any closer than that.

What does the data say?

Here is a sampling of Canadian economic data released in the past month.

- May CPI +0.9% y/y vs +0.8% exp

- April retail sales ex-autos -0.6% vs +0.3%

- April GDP -0.1% vs +0.1% exp

- Q2 BOC business outlook survey future sales 8 vs 4 prior

- June employment -6.4K vs -10.0K exp (but +64.8K on full-time jobs)

- June unemployment rate 6.8% vs 6.9% exp

The April retail sales report was the big shock but inflation numbers have been decent and the June jobs report was good.

The Bank of Canada loves its forecasts

The BOC tries to work in a structured way. Policymakers set out forecasts and when they misses, they grow more hawkish or dovish.

Here are the important forecasts they made in April and how the consensus has changed since.

- US GDP 2.7% in 2015 and 2.8% in 2016 (consensus: 2.3% and 2.8%, respectively)

- Global growth 3.3% in 2015 (IMF now sees 3.0%)

- The BOC forecast Q4 inflation at 1.4% y/y (consensus approx 1.1%)

- GDP Q1-Q4 (0.0%, 1.8%, 2.8%, 2.5% then avg approx. 2.2% in 2016)

- Private GDP (-0.6%, +0.1%, +2.2%, +2.4% then avg approx. 2.1% in 2016)

These numbers are why economists see a cut coming. The BOC looks closely at the 'output gap' and the time it will take for the economy to return to 'full capacity'. The stunted growth in H1 leaves Canada almost a full percentage point behind where the BOC thought it was headed.

How to trade the Bank of Canada decision

You can see why it's a tough call but I don't think the Bank of Canada will cut. Poloz has been Mr. Optimism since his January cut. He anticipated the lull in H1 growth (saying Q1 would be 'atrocious') and always assumed it would be temporary. Given the solid jobs growth, and that the outlook for H2 and the United States remains good, he will wait-and-see.

But that alone isn't the basis for a trade. It's almost equally important how the statement is worded. Also note that the Bank of Canada will also update its forecasts in the Monetary Policy Report released at the same time as the decision. Poloz and Deputy Wilkins will then host a press conference at 11:15 am ET (1515 GMT) so there will be plenty of twists and turns.

For the most part, I don't expect the BOC to slam the door shut on a September move but I don't see any kind super-dovish statement either. That said, CAD traders are tail-chasers and the gaggle of economists forecasting cuts will find something in the BOC documents to spin into a reason for a cut so even if the BOC doesn't cut and isn't particularly dovish, I don't rule out a USD/CAD gain.

What does the chart say?

The clincher for me is the USD/CAD chart. The 1.2800/1.28500 range has proven to be stiff resistance.

What worries me is the series of higher lows and higher highs since May. That's a bullish signal. And if that resistance line breaks, there is little top stop and extended run higher.

Final Thought

I don't see the need to be a hero in this trade and bet on the outcome. If the BOC cuts or his extremely dovish, then the break of 1.2850 is a 'go with'. It will extend easily to 1.32 or 1.33 in the coming days. I might miss the first 200 pips but I'll get the next 200+.

The downside is equally attractive. If Poloz remains Mr. Optimism I don't think the move will be quite as quick to the downside (maybe 100 pips) but the selling will continue for days and it will reinforce 1.2850 as strong resistance. Ultimately, I think that's a more lucrative trade because we could see 1.24 or 1.22.

*an important caveat. No matter what the BOC does or says, if oil moves another 10%, it will take the loonie along for the ride.